27 Dec A New Year Begins with Covid Still Lurking – 2022 Q1 Commentary

We would like to welcome you to a New Year and thank you for your continued trust as your financial advisor. It means a lot to us to work on behalf of you every day to protect and grow your wealth. We view it as a privilege and look forward to another year.

This year will undoubtedly come with its own ups and downs. We typically refer to these gyrations as volatility. One of the great volatility providers of the last two years has been Covid-19. The Covid Delta variant slowed life down during the summer of 2021 and during the Thanksgiving holiday we all became aware of the Omicron variant. Fortunately, the most deadly effects of Delta seem thwarted by vaccines. Omicron appears less resilient to vaccines but perhaps causes more minor side effects. Nonetheless as 2021 begins Omicron appears to be spreading at a high rate. So has the volatility in our “reopening stocks” been justified?

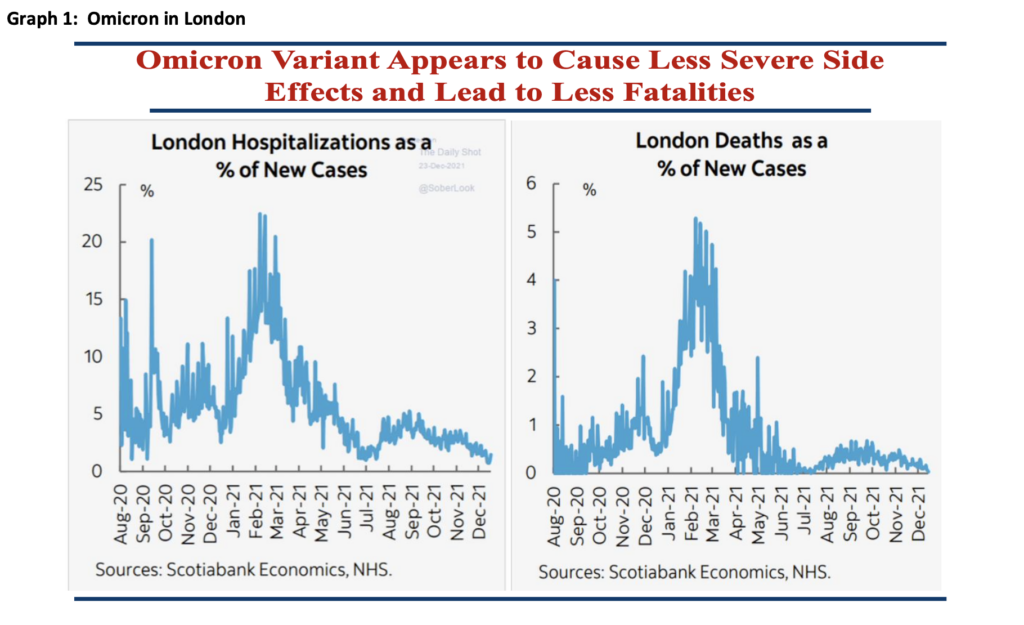

Based on Graph 1, the city of London has experienced both fewer hospitalizations as a percentage of new Omicron cases and a reduced number of deaths as a percentage of new cases. Both metrics demonstrate much lower percentages compared to a spring time surge in cases as well as the summer surge in Delta. Therefore, if this same pattern follows in the United States, which as we write appears to be the case, then Omicron would certainly provide less reason for concern. We have concern regarding the over extension of medical resources, both human and hospital beds, to manage increased cases. However, Omicron should not lead to prolonged downward pressure on the stock market and our investments related to “reopening.”

Although currently comfortable within the storm of Omicron, we would expect this year to have a degree of volatility. We noticed as 2021 drew to a close, that some of you might have forgotten what it feels like to experience stock market volatility. We admit to not minding the lower volatility following the severe decline in share prices as a result of Covid in the spring of 2020. However, the market and our portfolio does not go up in a consistent straight line – much to our disappointment. Instead, as we have mentioned before, you are rewarded for weathering volatility in your stock investments by, on average, higher returns over time when compared to other asset classes. We may go through periods of ups and downs, but over time we expect to invest in companies that are going to increase the value of your overall equity portfolio.

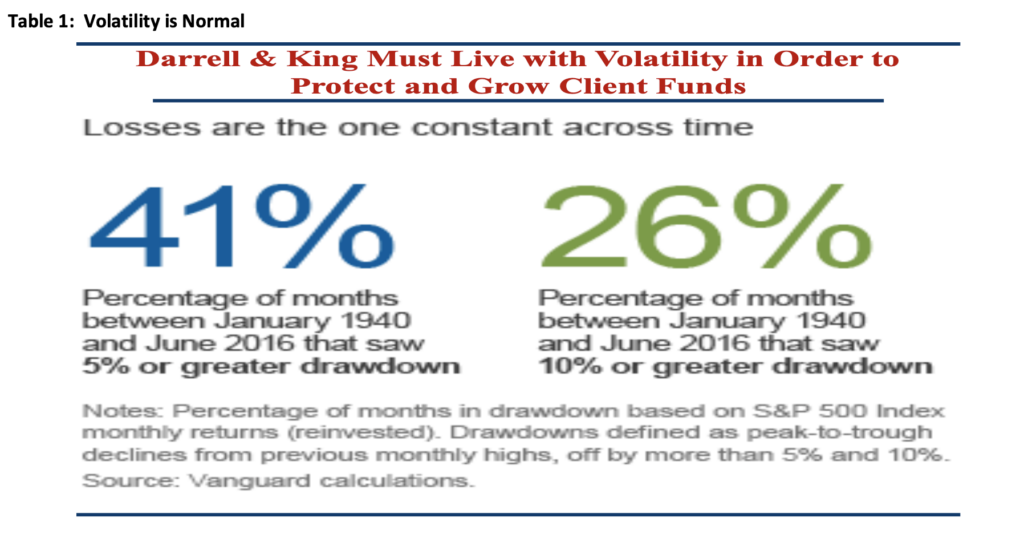

In fact, we expect a lot of up and down as we build your wealth. Table 1, one we have shared in the past, illustrates why we would expect a lot of volatility in the stock portfolio. An astounding 41% of months between January 1940 and June 2016 experienced a drawdown of 5% or greater in the S&P 500. Equally astounding, 26% of months in that time period experienced a drawdown of 10% or greater. So one cannot invest in the stock market without feeling the effects of volatility.

One tool to manage that, which we realize sounds trite but works, is to check your balances less frequently. You pay us to manage through the volatility – you do not need to also come on that journey. The other tool includes not using the mental accounting of pegging on your highest balance. If you do not focus on the high point, the volatility may seem less taxing to you. In the meantime, we keep our focus on finding great companies with the potential for great investment returns.

Happy New Year! We love to hear from you, so please reach out with any questions.

Sorry, the comment form is closed at this time.