01 Oct Thank You Wizard – 2023 Q4 Commentary

Charles G. King, who we all know as Charlie, joined Jack at John Stewart Darrell & Company in 1986. Jack and Charlie became friends while meeting for lunch at The Mousetrap diner in Charlottesville. Jack would pick Charlie’s brain for investment ideas. This friendly back and forth began a working partnership that would last for 37 years.

Charlie moved to Charlottesville to pursue an opportunity with another investment firm. However, prior to that Charlie had been named the youngest Director of Research at Wachovia Bank in Winston-Salem, NC. So, it was no wonder Jack wanted the opportunity to discuss investing with Charlie. That early recognition of Charlie as an investment mind and standup individual blossomed into a business relationship. Jack asked Charlie to become a named partner and John Stewart Darrell & Company became Darrell & King.

The “Wizard of White Gables,” as one friend of the firm describes Charlie, displayed keen investment acumen and steady hand shepherding the portfolio and our clients through several economic and market cycles. Those attributes led to wonderful results. Charlie’s career did not come without challenges though. In the mid-90’s Charlie and Jack recognized that a strictly “value” investment style – investing in only low Price-to-Earnings or low Price-to-Book stocks – did not always work. In fact, there were occasions when a value strategy did not work for extended periods of time. Charlie had the vision to adjust the investment strategy to a more opportunistic strategy, which could include higher Price-to- Earnings stocks, if the expected return on investment merited a higher current valuation. That nuanced update to the strategy happened just prior to the tech bubble of late 90’s.

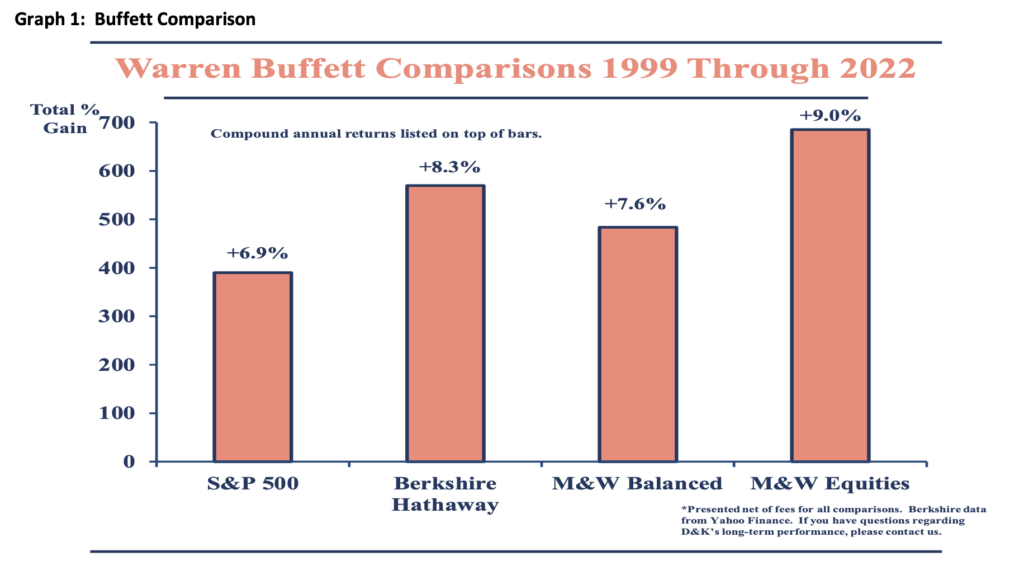

During the tech bubble a few of our clients questioned our lack of participation in the high flyers of the day. Charlie maintained his sights on valuations, knowing that a company whose stock traded at 100x sales would likely never show a great investment return. So Darrell & King remained out of the tech fray and focused on undervalued and under-invested companies. When the S&P 500 crashed in 2000, 2001, and 2002, money flowed into the D&K portfolio and it experienced growth. That set the stage for the next two decades and the results as displayed in Graph 1, below.

Charlie never let these results or catchy monikers dominate his psyche. He is a devoted Christian, husband, father, and grandfather, who has a clear North Star and greater calling. When he retires on December 31st it will be sad but Charlie is comfortable with his choice and looks forward to the future. Please join us in thanking Charlie for his service to our clients for four decades.

Indeed, we thank Charlie for his wisdom, for his kindness, and for helping set a work culture that is both serious and focused, while remaining lighthearted. We will certainly be losing the best dressed member of our team – Charlie’s mother and sister impressed a keen fashion sense on a younger Charlie. However, Charlie plans to remain nearby, continuing as a resource. One of Charlie’s great gifts to us and our clients is an enduring investment strategy that Morris & Wells will continue.

We understand that many of you have grown close to Charlie over the years. We all have too, and we will miss him. Charlie and his wife Carole enjoy travelling the world together and we wish them the best in their future adventures. May the road rise up to meet them but also lead them back home!

If you have any questions, please reach out to us. Our firm is always happy to help. Thank you for your support and encouragement. Morris & Wells believes in its ability to manage your investments and offer financial planning appropriate to your family or organization. We are excited to continue that effort into the future.

Thank you Charlie!

Sorry, the comment form is closed at this time.