01 Jul Summer Excitement – 2019 Q3 Commentary

The old Wall Street adage of, “Sell in May and go away,” appears prophetic this year. However, if we had done that we would have missed the rising stock market during June. For those clients who feel that the last 18 months in the stock market has felt like a bit of a roller coaster, you are correct! When we look at the prior 18 months compared to the 18 months before that, we can all agree that the recent market history has been more tumultuous.

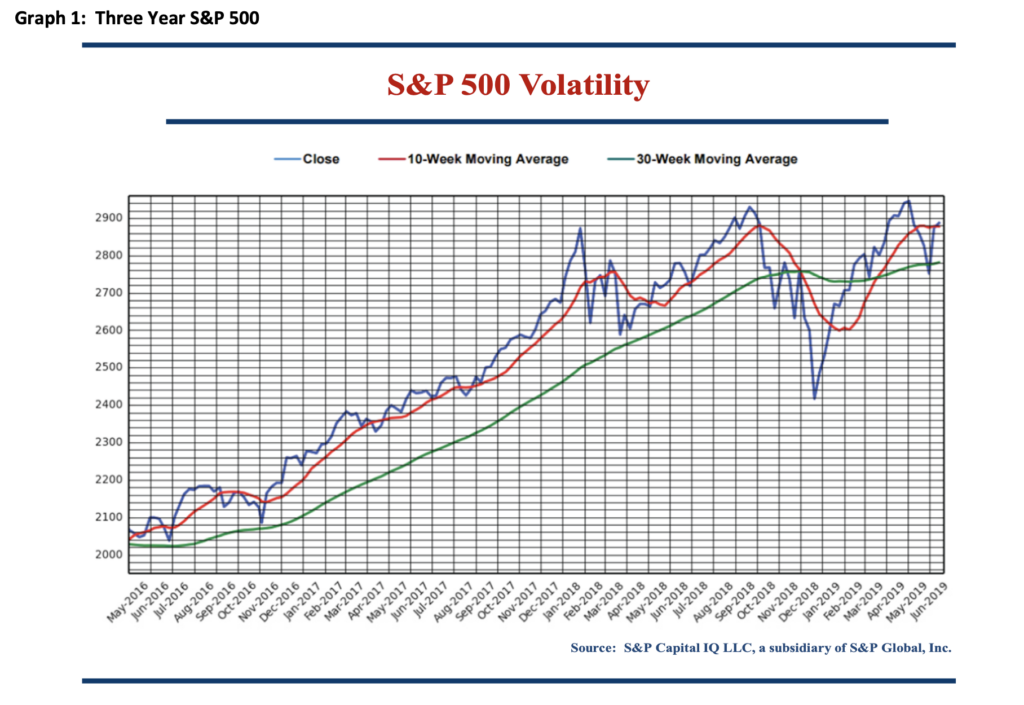

Graph 1 illustrates that from May 2016 to the beginning of 2018 the S&P 500 enjoyed a fairly smooth upward trajectory with little volatility. Investors and portfolio managers alike appreciate good times like these. The psychological aspect of keeping money invested in the stock market is certainly easier. Then a period like the first four months of 2018 hits us. At that time we get reminded together that part of why investors have made more money investing in stocks over time compared to other less volatile assets is for accepting and enduring that volatility.

Despite the decline in the S&P 500 during the beginning of 2018, as depicted in Graph 1, the index attained a new high by the end of the third quarter. Then during the fourth quarter of 2018 the market gave us another period that challenged our psychology and had us even busier than usual on the phone around the end of the year. At that time we judged nothing was fundamentally different about our investments and that valuations remained quite reasonable. We have seen that borne out so far during 2019. We worked through the psychological challenges of the fourth quarter. In fact on Christmas Eve, a holiday shortened trading day, the S&P 500 was down almost 3% intra-day. However, we added to positions for clients who had recently added cash to their accounts.

Adding to the volatility of the recent 18 months, the stock market piled on with a down 10% S&P 500 month of May. A significant portion of that was tariff talk related. We remain upbeat about tariff resolutions, but expect this sort of volatility to remain. Despite all of the perceived pain of the last 18 months, and even within it, one can see on Graph 1 that the S&P 500 has trended higher during the period – compensating you for accepting and enduring the volatility.

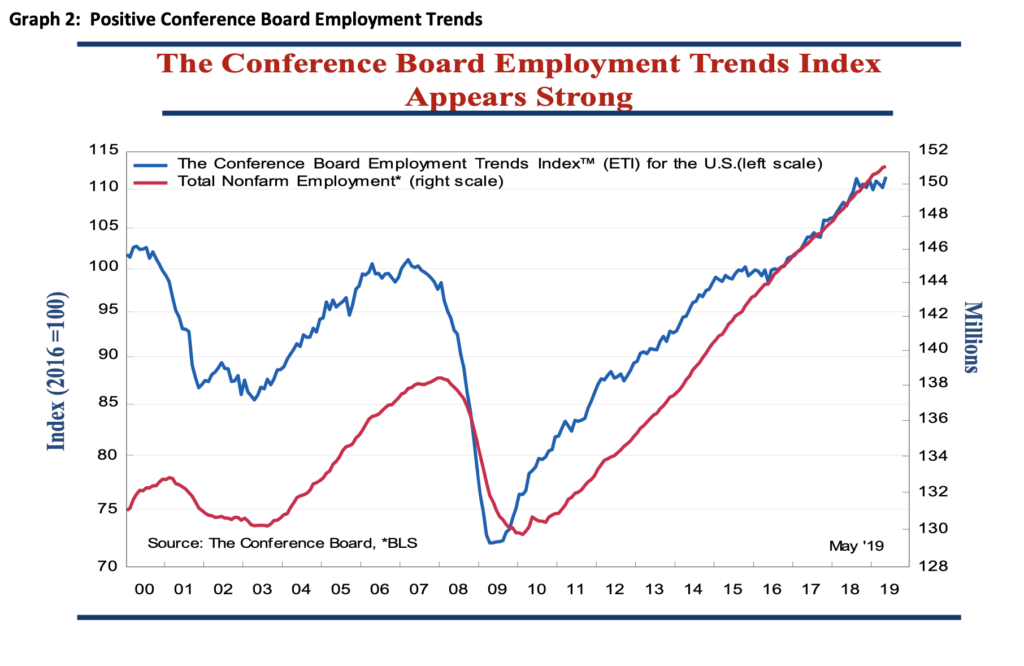

With the market action of the preceding 18 months, one might think that the economy and stock market are collapsing. We find some positive reference points though. First of all, despite pockets of overvaluation, we do not find the market overvalued at this point. Meanwhile, we see pockets of deep undervaluation. Graph 2, below, illustrates The Conference Board Employment Trends. US employment remains strong. In the recent past, employment did not decline until the end of 2007 and dramatically dropped into the housing crash. So we remain positive regarding that element of the economy. Similarly, most of our companies have reported growth year-to-date. We do not see a period of active corporate capital expenditure retrenchment. Therefore, from our perspective above, at the end of the second quarter the economy and market contain several positive factors.

We remain vigilant for indicators that would deter our positive outlook, and in the meantime embrace the volatility. Thank you for the trust you place in us!

Sorry, the comment form is closed at this time.