01 Jul Artificial Intelligence Takes Over – 2024 Q3 Commentary

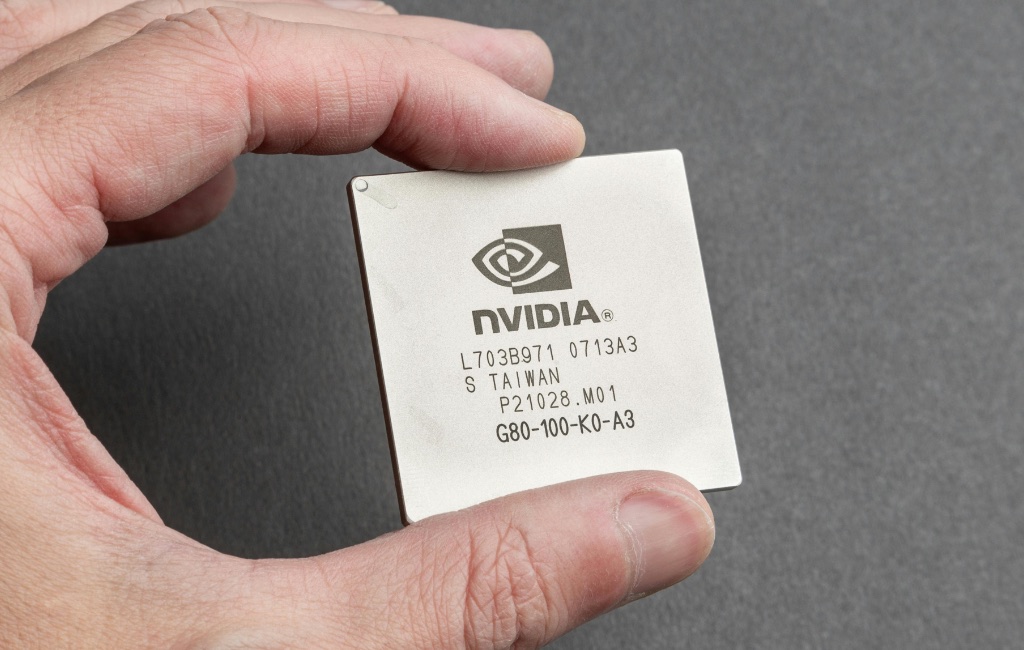

If you were to turn on the financial media or pick up any of the major global newspapers, you would be hard pressed to not find a segment or an article on the current moment’s corporate sensation – NVIDIA Corporation (ticker: NVDA). The company even becomes a topic of conversation if you bump into a bus of retirees from Nebraska in Yellowstone National Park. The reason for NVDA’s move to global prominence is that it designs Graphics Processing Units (GPUs). GPUs can be found in all kinds of electronic hardware used for Artificial Intelligence (AI) processing, including so-called Large Language Models (LLMs). As a result of the demand for NVDA’s GPUs, the company’s year-over-year revenue grew 262% during its first quarter of 2024.

We would describe that kind of revenue growth for NVDA and at a net income margin of 57% as World-Class. If a company receives that sort of description, no one questions its emergence as one of the top three largest companies, by market capitalization, in the world. At the time of writing, NVDA is going back and forth with Apple and Microsoft for that moniker. In the meantime, NVDA’s market capitalization (shares outstanding multiplied by share price), matches the combined market capitalizations of several of today’s great companies – see Graph 1 below.

When a company grows to the degree of NVDA over the last couple of years, one can make all kinds of size comparisons. Graph 2 demonstrates that NVDA’s market capitalization has surpassed the UK, Germany, and France’s individual corporate market capitalizations. The same can be said of a couple of the world’s largest companies, but the speed NVDA achieved this milestone has captured the market and individual investors’ attention. Similarly, Graph 3 illustrates that NVDA gained $1 Trillion of market capitalization within 30 days during 2024, while it took a Warren Buffett controlled Berkshire Hathaway more than the 30 years. What does all this mean for the market and how might it impact M&W clients?

The recent effect of NVDA’s growth on the stock market has been significant. A majority of the financial media and many of you view the S&P 500 index as the “stock market.” The S&P 500 index is market capitalization weighted, which means the larger an individual component’s market capitalization, the larger that company’s impact on the index return. So, NVDA’s impact on the S&P 500 index return over the last 18 months has grown significantly.

In 2023, NVDA returned the best performance of the S&P 500 and year-to-date 2024, at the time of writing, NVDA returned the second best performance in the S&P 500. Table 1, illustrates that an effect of the above is that over the last year only 6% of the S&P 500 index members has outperformed the return of the index. Wall Street pundits have expressed a lot of concern that the so-called “narrow breadth” of the S&P 500 index’s performance portends trouble for the broader market in the future.

We certainly agree that S&P 500’s recent performance has been driven by a narrow group of large technology companies, some of which we have owned over time. We do not agree that this means the overall stock market needs to decline dramatically. In fact, at the time of writing, the S&P 500 Equally Weighted increased 5.5% and the Value Line 1700 (largest 1700 US stocks equally weighted) actually decreased 1.8% year-to-date. From our point of view, the average stock has not rocketed to new heights like NVDA and some of its large market capitalization brethren. We believe that allows quite a bit of room for some of M&W’s high quality portfolio companies to join in with improved performance over the course of the year. The froth and attention we see in some parts of the stock market simply do not prevail over the whole stock market.

In terms of where that leaves M&W as it relates specifically to NVDA, as of today we feel we have missed the investment opportunity. NVDA’s current valuation appears neither overvalued nor undervalued, but fairly valued given the current growth and earnings expectations that analysts have for the company. We believe that if earnings growth continues to come through, on balance, the stock will continue to appreciate to some degree. However, we also know that the semiconductor industry is cyclical, which means that earnings rise and fall based on the cyclicality of consumer demand. So, to the degree that the current GPU cycle moves to an “over supplied” situation, companies like NVDA’s earnings growth will slow and the stocks’ valuations will likely rerate negatively. If we knew the current GPU cycle will continue unabated for 10 years, then we would be adding NVDA to the portfolio today. However, we do not know the length of the current cycle, only that at this moment NVDA is performing exceptionally within the cycle – a fact the market clearly understands.

We conclude by affirming that we perceive AI as a very real investment opportunity and possibly game changing for corporate America – in terms of potential efficiency gains and a variety of additional enhancements. We also believe the current GPU cycle to be real and necessary to support AI use cases. However, we do not yet have confirmation that the GPU business has broken its historical cyclical mold, which means that related stocks will be vulnerable to either a slowdown in demand or an oversupply. In the meantime, we are trying to find the next NVDA for the portfolio.

Thank you for your trust and confidence in our firm. As the year progresses, please remember that we are happy to converse (via phone or electronically) with your tax accountant regarding quarterly estimates and planning around those. M&W tries not to let the tax tail wag the portfolio dog, but every year, beginning in November, we analyze the portfolio for tax-loss selling (taking losses for tax purposes, only to purchase the investment back a month later) opportunities. At the current moment that analysis would not provide many opportunities, but we will revisit later in the year. If you have any additional questions, please reach out to us via phone, email, Zoom, or a knock on the door. We are always delighted to talk.

Sorry, the comment form is closed at this time.