22 Sep Can Corporate Net Income Margins Remain at Today’s Level – 2021 Q4 Commentary

During a time when a number of possible economic and stock market related concerns flow from the media, we would like to share some thoughts regarding a longer-term question. Since the Great Financial Crisis of 2008, companies within the S&P 500 experienced a significant increase in their net income margin. We wonder whether corporate net income margins can remain at today’s level?

Net income margin represents the bottom line profit that a company generates. So if a company has a net income margin of 14%, then for every dollar of product or service it sells, it earns 14 cents. Companies generally get valued by investors on that remaining net income, which after capital expenditures should approximate the cash flow of the business. As a result of technological efficiencies within US corporations and other benefits attributable to the scale in some of the technology businesses that dominate the S&P 500, average S&P 500 company net income margin have exploded since 2009 (see Graph 1 below) and from the long-term average net income margin before that.

The above dynamic has positively benefited your portfolio and the valuations ascribed to a number of companies – because generally speaking, greater cash flow leads to greater valuations for our individual investments. Many market participants wonder if this move in corporate net income margin away from a lower long-term trend means that the margin has to revert to that lower level. We do not believe net income margin has to revert all the way to prior lower levels. However, we do note several headwinds that have arisen from the Covid-19 pandemic.

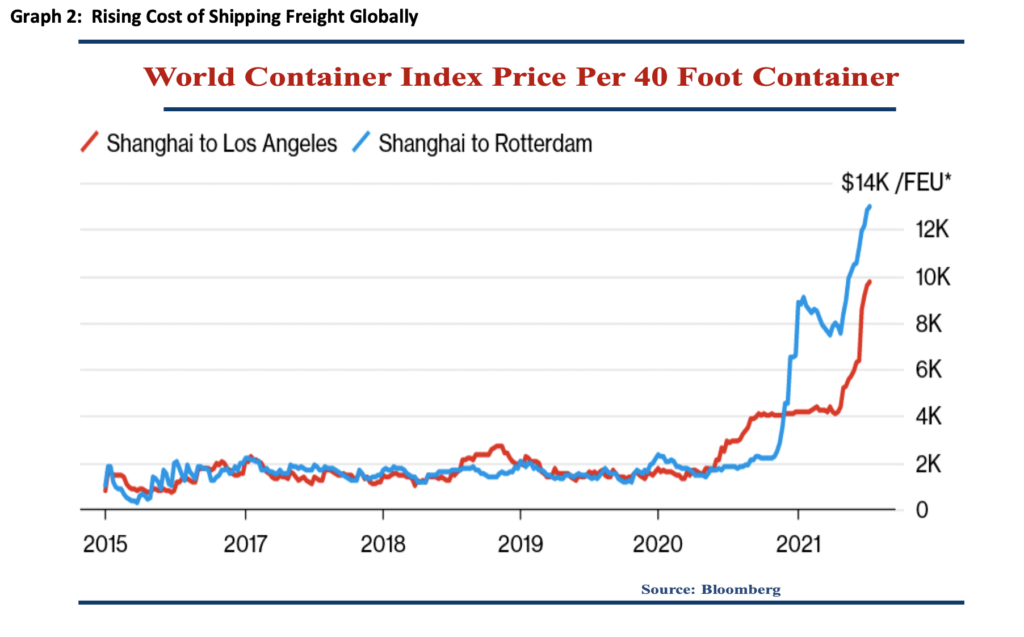

We can all point to examples in our own lives of rising costs, supply chain constraints, or labor shortages – that all seem to stem from the Covid-19 disruption. For example, Graph 2 illustrates the skyrocketing cost of shipping a 40 foot box from Shanghai to Los Angeles and Shanghai to Rotterdam. Corporations have two choices when faced with such severe rising prices. They can pass them through to the end customer or absorb them. Absorbing cost increases like this would most certainly decrease the company’s net income margin. For a company dealing with the cost increase shown in Graph 2, the cost jump would likely be split between the company and the end customer.

The United States Federal Reserve currently suggests that the price increases seen in shipping in Graph 2, and many others you see in your day to day live are transitory – meaning prices will not stay elevated forever. That is an open question and interesting discussion for another time. However, the current situation leaves us looking for companies that can maintain their net income margin and even increase it. This implies seeking companies that can decrease other costs if for example labor cost increases, or companies that can pass through price increases as mentioned above, or companies whose revenues grow in a way that offset rising costs. Although, the average S&P 500 member’s net income margin may decrease from recent highs, we believe our investment strategy can unearth opportunities that remain more resilient to margin pressure.

Thank you for letting us help you navigate the investment landscape! If you have any questions, please reach out to us.

Sorry, the comment form is closed at this time.