29 Mar Can Stock Prices Withstand a Rise in Interest Rates? – 2017 Q2 Commentary

The United States Federal Reserve’s Federal Open Market Committee (FOMC) recently suggested it will target a range of 0.75%-1.00% for the Federal Funds Rate (FFR) by the end of 2017. That implies two more increases for the year. The FFR is the rate that other longer-term interest rates are based on. Investment theory suggests that a rise in interest rates will negatively affect the price of stocks and price of bonds. We take a less definitive view of that as it relates to stocks and do not believe that simply because interest rates increase, the stock market will go down.

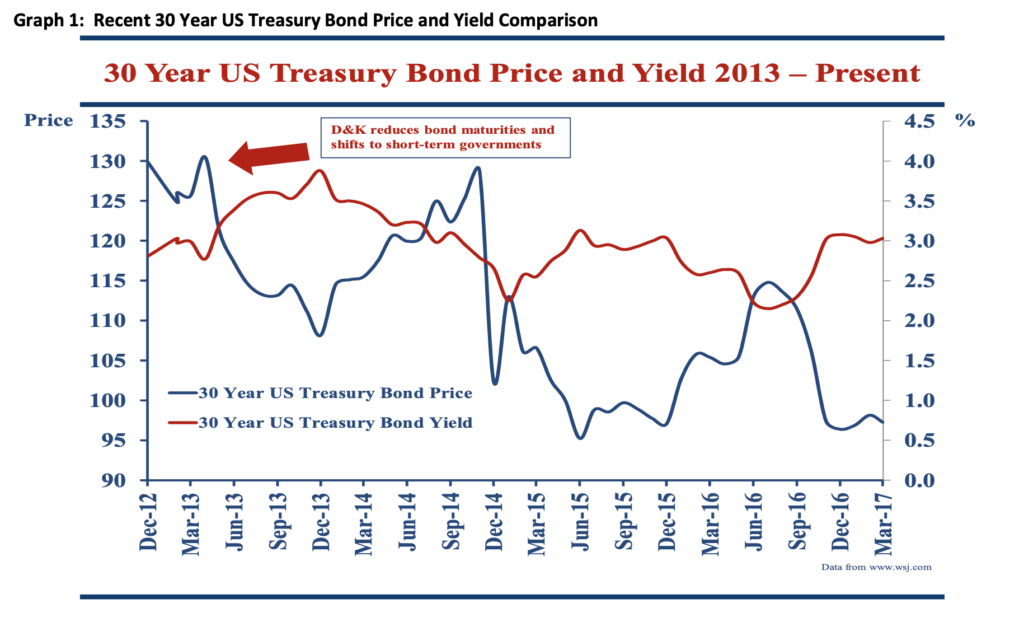

At the beginning of 2013 we wrote to you suggesting we had concern of a “Bond Bubble Blowout.” Not all of our clients hold bonds, but for those who do, at that time we shortened the maturities and invested in only short-term US Treasuries. We believed that if rates rose we would preserve your capital and have the opportunity to reinvest in a way that would not destroy your purchasing power. Over the last three years that decision has looked both wrong and prescient. However, from point to point, the end of the first quarter 2013 to mid-March 2017, it looks like a beneficial decision. Graph 1, illustrates that during that period the 30 Year US Treasury Bond has declined in price by 23%.

Similar to the effect on the price of bonds, market participants believe that rising rates will lower the price of stocks because the companies’ cash flows must be discounted using a higher risk free rate. If rates are higher, you receive more for holding your money in a savings account so you necessarily require a higher return from stocks for their higher level of risk, which decreases stocks’ prices. With that in mind, why would we believe that the stock market could withstand a rise in interest rates?

Our primary reason for believing the market can withstand a rise in interest rates stems from something we have mentioned previously. If the market believed that rates would remain as low as quoted today or needed to stay this low for an extended period of time, then Price-to-Earnings ratios would sit noticeably higher than they do today. This means that the market as a whole would be higher than we see today. So we see the market as having an increase in interest rates already built into its expectations. Therefore, a telegraphed, small, and incremental rise in rates by the FOMC appears possible for the stock market to absorb.

Secondly, if the US economy continues to expand, we believe the market can withstand rising rates independent of stock market valuations. Graph 2, illustrates the last three years’ annual rate of US real gross domestic product (GDP). With an average during the period of 2.1%, GDP resides below the long-term average growth of 3.3%. So if GDP continues to grow toward the longer-term average or surpasses it and labor markets remain on the mend, we could reach an economic climate that warrants an increase in interest rates. In this scenario, the improving economy outweighs any negative effects of rising rates on the market.

As always, we remain aware of the machinations in the market that concern you about potential future price moves. We thank you for your trust in navigating those and believe that the dynamic US economy can continue to grow.

Sorry, the comment form is closed at this time.