20 Dec Election Years and the Stock Market – 2020 Q1 Commentary

A Presidential election year can provide several questions for markets. Indeed, 2016 provided a lot of volatility as the candidates and then the election sorted themselves out. During that process the S&P 500 endured a correction, bottoming in February, and then the index went on to finish the year with a strong return. We can envision a number of scenarios unfolding in 2020’s election year. In our third quarter 2012 newsletter we covered the Presidential Election Effect. We thought it would be interesting to revisit that piece and the related data to see how it could inform us about the coming year.

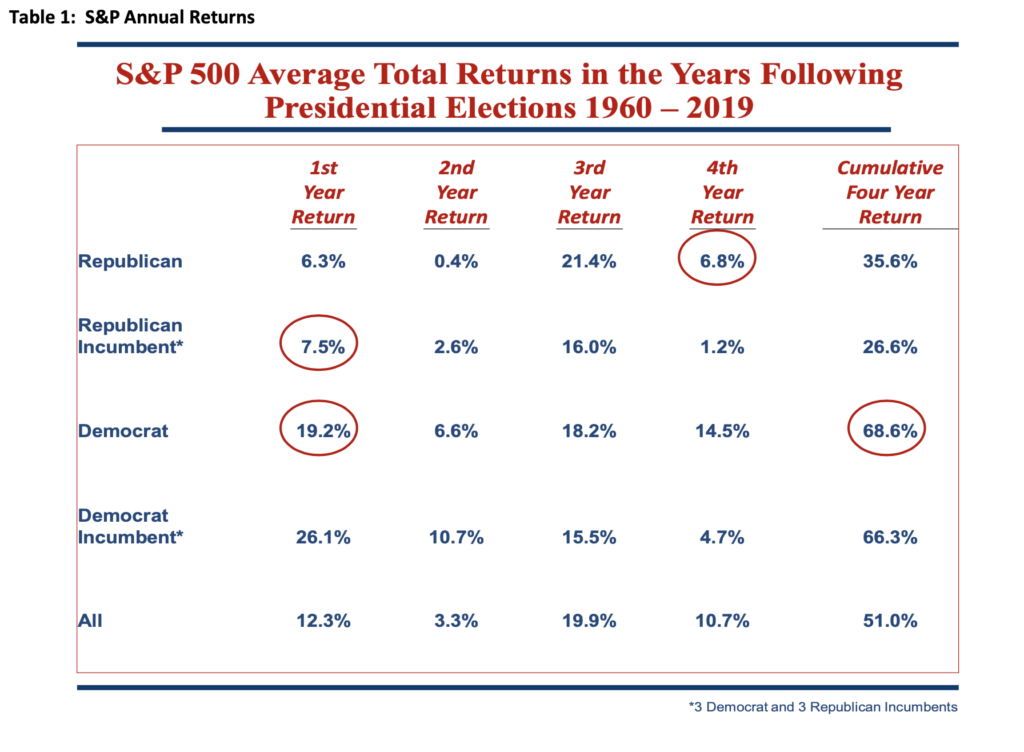

Similar to 2012 we chose to view the data from 1960 (following the 1959 election) through 2019, as well as 1925 through 2019. The data from 1960 eliminates fluctuations resulting from World War II and the Great Depression. These data (see Table 1) suggest that the S&P 500’s return during the fourth year of a Republican president’s term (i.e., the election year) seem normal. We can say the same for 2021 if President Trump wins reelection. Post 1960, the S&P 500 return of the first year of an incumbent Republican president’s second term has been normal too. Meanwhile, as we write this letter at the end of 2019, the year almost ended has followed historical trends for Republican presidents in that the third year of their first term has yielded the highest S&P 500 annual return of all the possibilities for Republicans. With 2019 in the rearview mirror we look forward.

Whether the historical trend persists for 2020 and then into 2021 depends on a number of factors. We consider the economy and companies continuing to grow their earnings within the economy as the primary factors for stock market performance over the next couple of years. During 2019 our portfolio companies experienced a mostly positive operating environment and one in which those companies’ earnings growth persisted. Reasonable people can disagree on how the early candidates for the Democratic nomination for president will support corporate growth relative to the would-be incumbent. However, the S&P 500 has performed, on average, better with a Democratic president in office than a Republican president based on the data in Table 1 and Table 2.

Throughout 2020 we expect there to be a lot of harsh rhetoric and accusations coming from both sides of the political aisle. With the constant focus by the media and rapid dissemination of the candidates’ attacks we would not be surprised to receive an actionable investment idea from the 2020 political slugfest. That will likely come in the form of one side casting a negative light toward an industry or company. The industry or company will then navigate operationally through the related temporary share price setback. We will attempt to maintain a steady hand and guide the portfolio forward by taking advantage of opportunities like the above.

Thank you for your sustained trust. We wish you a joyful and prosperous 2020!

Sorry, the comment form is closed at this time.