01 Apr Fragility in the Banking System – 2023 Q2 Commentary

US stock markets came under pressure in mid-March as investors scrutinized the banking system and a few banks experienced “bank runs.” We believe the Federal Deposit Insurance Corporation (FDIC) stemmed the bank runs on Sunday March 12th by backstopping depositors of Silicon Valley Bank (SVB), the banking arm of SVB Financial Group. How did we get to that point though and where do we go from here?

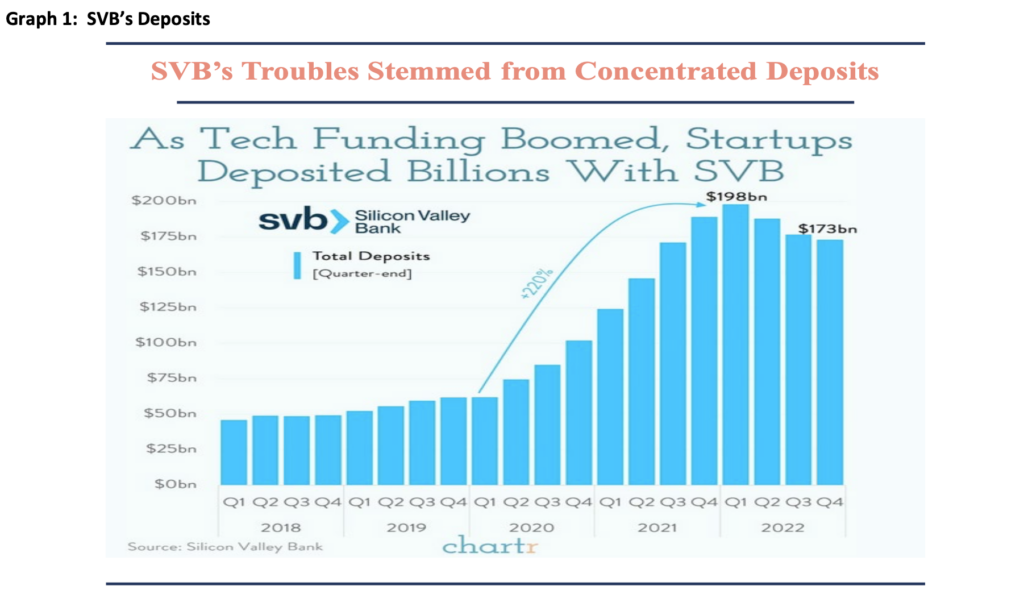

SVB experienced a meteoric rise in deposits over the last three years, which you can see in Graph 1 below. The increase in the bank’s deposits stemmed in part from an inflow of investment into Venture Capital (VC) funds and an inflow of investment into the companies that VCs select as investments – both banking with SVB. That dynamic left SVB’s deposit base relatively undiversified. When the VCs faced losing investments following poor performance of the technology sector during 2022, the funds needed capital from SVB for their various other commitments. Similarly, the companies the VCs invested in needed capital from SVB as a matter of course – most burn cash instead of generate it during the startup phase.

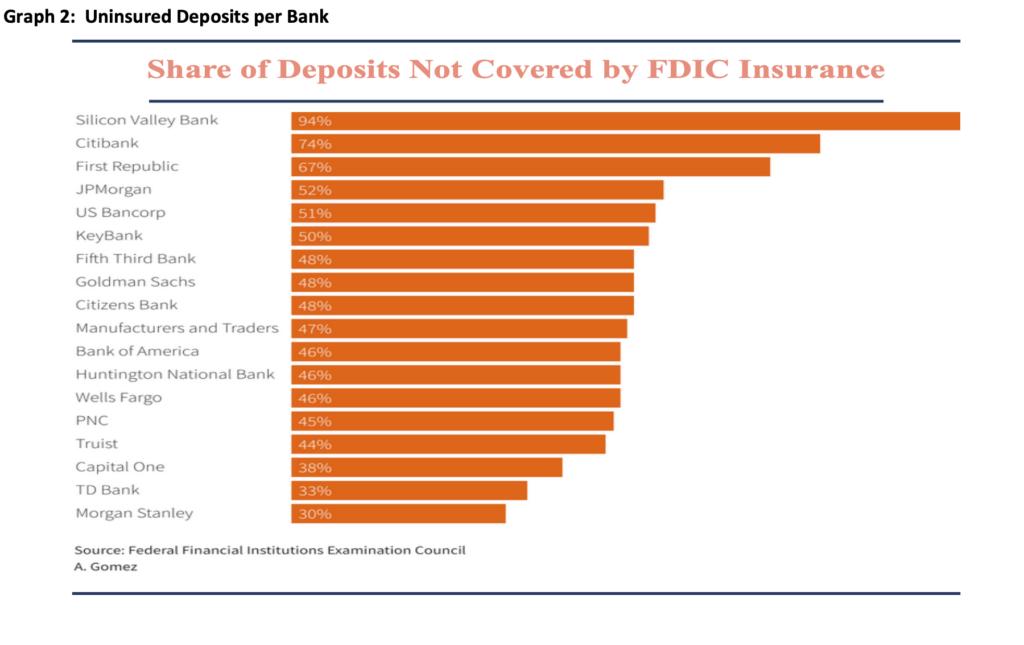

The above dynamic led to these and other depositors attempting to take their money out of SVB. In order to meet the cash demands of its depositors, SVB had to liquidate assets. When SVB had to sell $20 billion worth of assets it immediately realized a $1.8 billion loss. The loss occurred because so-called “Held-to- Maturity” (HTM) securities faced unrealized losses since interest rates had risen, which drove the securities’ prices down. The forced realization of losses to meet deposit requests helped trigger a traditional run on the bank at SVB. Graph 2, below, illustrates why a bank run at SVB would gain momentum. As a percentage of deposits, uninsured deposits at SVB amounted to the highest percentage of deposits among large banks. The third largest percentage could be found at First Republic – a bank that received a coordinated bailout from several larger banks. The run at SVB did gain momentum and as noted above, we saw the FDIC step in to support depositors.

We believe the FDIC contained a more widespread run on the US banking system. We also think this episode demonstrates the fragility within the global banking system. The world economy needs the banking system to function as a supplier of credit. However, even under strict capital requirements most banks would suffer if they were forced to sell assets that have unrealized losses. The FDIC’s actions seem to have safeguarded the general public’s trust in the system. Our fragile system relies on that trust.

We all live with a certain delicate equilibrium in our lives – we view it as part of the wonder of the human condition. Volatility within the market system provides us investment opportunities. We are currently analyzing investment opportunities related to this bank run. You may feel uncertainty around the situation but we are focused on investing in corporations that are moving forward and growing their earnings. If you have any questions at all, please contact us. We enjoy hearing from you and thank you for the continued opportunity to protect and grow your assets.

Sorry, the comment form is closed at this time.