02 Apr Keep Calm, Adjust, and Carry On – 2020 Q2 Commentary

First and foremost we hope that all of you are physically safe and in good health. We are well and working together (at least six feet apart) from the Darrell & King office. We all have the capability to work from home and communicate with each other and you – should the definition of essential change.

The spread of the novel Coronavirus and connected disease, Covid-19, has negatively impacted financial markets in a sudden and dramatic way. Chart 1, below, illustrates the significant drop in the Dow Jones Industrial Average (Dow) on Black Monday 1929 and the following Tuesday, as well as Black Monday 1987. March 12th and the following Black Monday 2020, March 16th, compare to the historic declines. Those sorts of movements feel awful and we have spoken, emailed, and met with a number of you who are rightfully concerned both for your health and others’ health as well as your financial resources. We want you to know that we have not been hiding under our desks. This sort of volatility is exactly the opportunity that we constantly discuss with you. As a result, if you are comparing a February 2020 statement to a March 2020 statement you will notice significant changes in the portfolio.

Coming into the end of February we held some cash and had been positioned more conservatively than at any point since the 2008 financial crisis. As the market sold off and gave us better prices, that cash was redeployed into high quality companies that we believe have a clearer pathway to earnings – even in a wobbly economy. We did not stop there. As the market decline increased in magnitude we sold a number of stock positions of companies that may especially struggle in a Coronavirus hampered economy. In exchange we moved into stocks of companies that would face less difficulty in that environment and would thrive once Coronavirus fear subsided.

In terms of the financial markets, that becomes the key question for us – when does the fear of the Coronavirus stop and when can the economy safely function again? We do not know the answers to these questions. We do know that by the time we all feel comfortable and things return to “normal,” the stock indexes will have moved positively from the lows of this particular market decline. So we work and optimize the portfolio during this difficult time of social distancing.

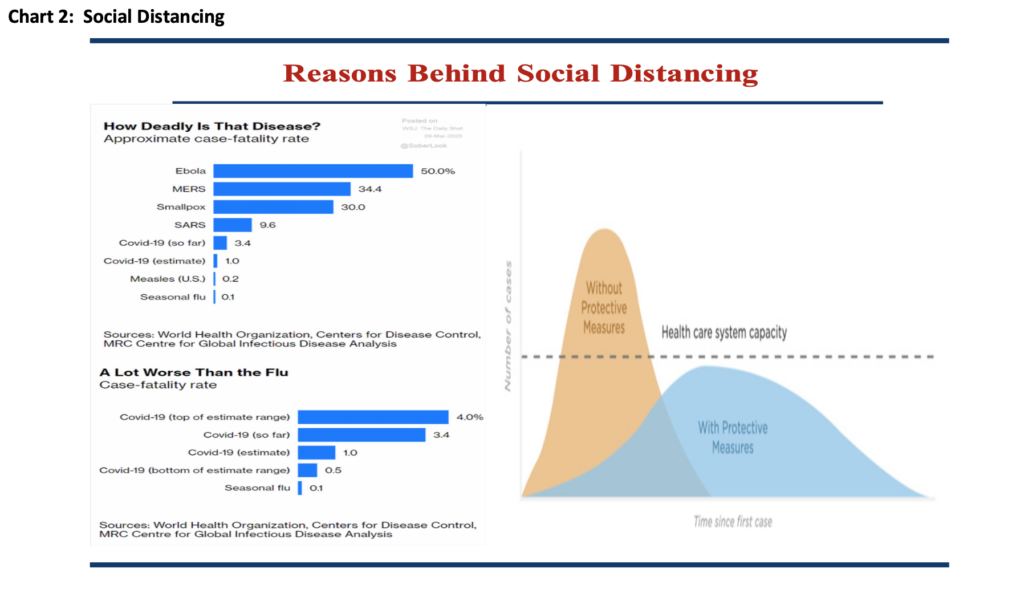

The term social distancing is likely new to you. It was certainly new to all of us. As Chart 2 illustrates, Covid-19 is more deadly than seasonal flu, but not as deadly as some other diseases in recent memory. The current projections from the scientific community as well as experiences of certain US hotspots exhibit stress on the US health care system. Chart 2 demonstrates how social distancing is supposed to reduce that stress. We have witnessed the social distancing in our community and others around the US and world. We are optimistic that social distancing will “impact the curve.” That outcome would take us a long way to answering our question regarding fear and allowing the economy to function in a more normal manner.

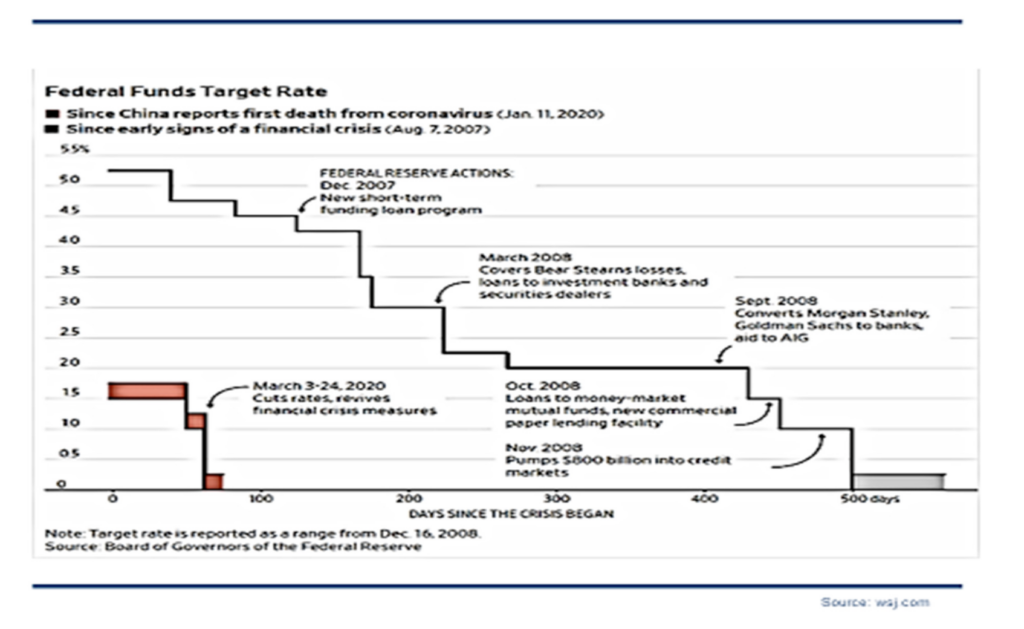

The state mandated shelter in place guidance that many of you are facing, along with us here in Virginia, is all supposed to hasten the reduction in steepness of the curve of Covid-19 cases. On the economic side of this complex equation, the Federal Reserve (Fed) and our Federal Government are employing unprecedented tactics to offset the reduction in commerce. For example, the Fed has reduced the Federal Funds Rate to 0% as of mid-March in order to facilitate the movement and lending of money. During the stock market crash of the 1920’s and 1930’s the Fed increased rates, which created more stress on the system. During this crisis the Fed has also purchased mortgage bonds and other securities to keep the system liquid. Similarly, Congress passed the CARES Act, which aims to support individuals, businesses, local and state governments, and health systems during a time when corporate cash flows are drying up due to a decrease in revenues. We want to emphasize that all of the above measures have been implemented during a time of extreme uncertainty and perceived threat to the US citizenry and our economic system. How these solutions are ultimately paid for may not be as important as keeping the system functioning in the present. We appeared underprepared to battle a pandemic as a country. Therefore, the response has been as swift and dramatic as possible, as demonstrated by Charts 3 and 4. These charts illustrate that both the Fed and Congressional response to the Coronavirus crises occurred much faster than to the 2008 Financial Crisis. We do not write off the possibility of further fiscal stimulus either. With all of this going on around us, our focus is the future of your financial assets.

The changes we have made in your portfolio to date and may make in the future with the threat of Coronavirus still hanging around are all executed to benefit your portfolio in the months and years ahead. Once the virus is controlled and the US economy restarts we envision a lot of pent up demand and a desire to continue the American dream. Our stock portfolio is positioned across great companies that will take advantage of that, but in the meantime can sustain themselves through a slower economic period. Historically, you get paid a 6% risk premium to hold stocks precisely because you do not know for sure what the future will bring. We believe America’s economic future will be brighter than today.

One way or another this is likely a stressful time for you. We work in part to remove the stress in one area of your life. As the market swings wildly in the short-term, please know that we remain diligent in making your portfolio as high quality as possible. Please contact us any way you would like and ask us anything. We are not just managing the portfolio. We can also advise on anything financially related in your life – including situations that the Coronavirus may have induced.

Sorry, the comment form is closed at this time.