01 Jan Looking Forward While Reflecting on 2023 – 2024 Q1 Commentary

2023 Review

We would like to begin by thanking all of our clients for a wonderful 2023. Internally, we believed that the outward manifestation of our succession plan and transition from Darrell & King, LLC to Morris & Wells Wealth Management, LLC would move smoothly. Thankfully, that belief became reality. We appreciate you continuing the journey with us.

As we exited 2022, we began 2023 pretty excited for the prospects of our portfolio holdings. A down 2022 contributed to that, but our portfolio companies’ management teams were also optimistic about their business prospects. This enthusiasm carried forward as the M&W portfolio performed during a period of broad stock participation within the S&P 500 in the first two months of 2023. However, we experienced a banking crisis in March and the stock participation within the S&P 500 became much narrower – meaning that a few large technology stocks drove the performance of the index. Fortunately, our portfolio also performed during the latter period.

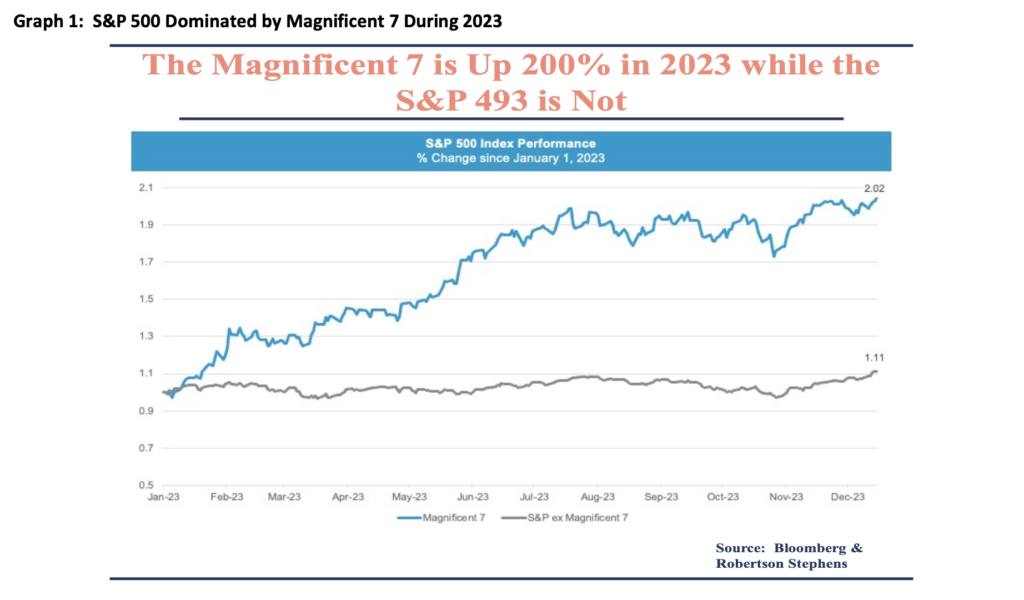

Our portfolio did contain two of the so-called “Magnificent Seven” – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. However, it was a number of other investments that drove M&W’s stock performance up during the year. Graph 1, below, shows the outperformance of the “Mag 7” versus what we will refer to as the S&P 493 – every company in the S&P 500 except the Mag 7.

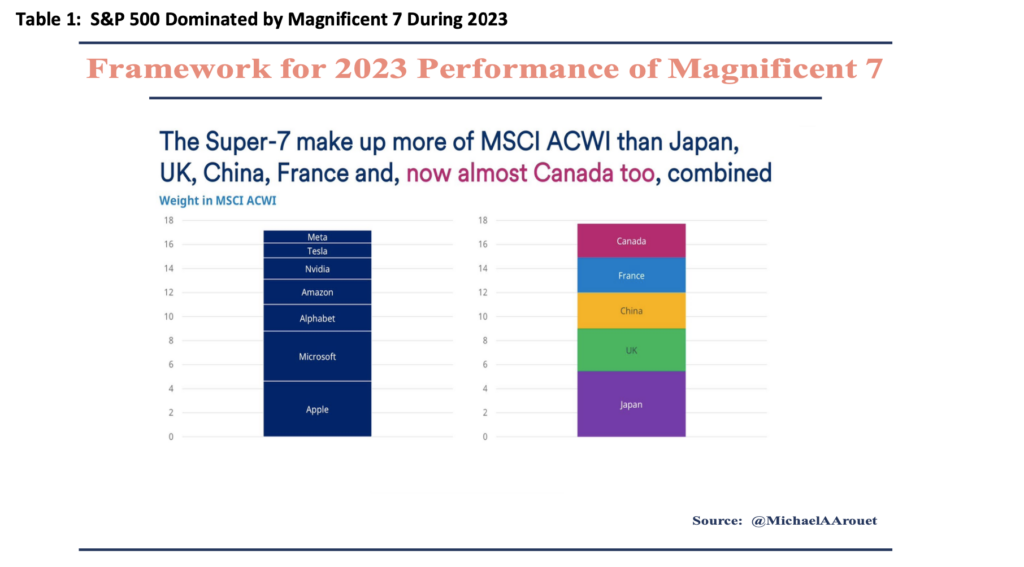

For perspective, as shown in Table 1, below, The Mag 7 now makes up more of the MSCI All World Index (ACWI) than Japan, the UK, China, France, and almost Canada combined. We have witnessed much gnashing of teeth over the question of whether the S&P 493 will catch up to the Mag 7 in 2024, or whether the Mag 7 will decline in price to come down to the S&P 493? The Mag 7 includes a collection of incredible companies and rather than focus on the previous questions, we continue to search for quality companies at reasonable valuations.

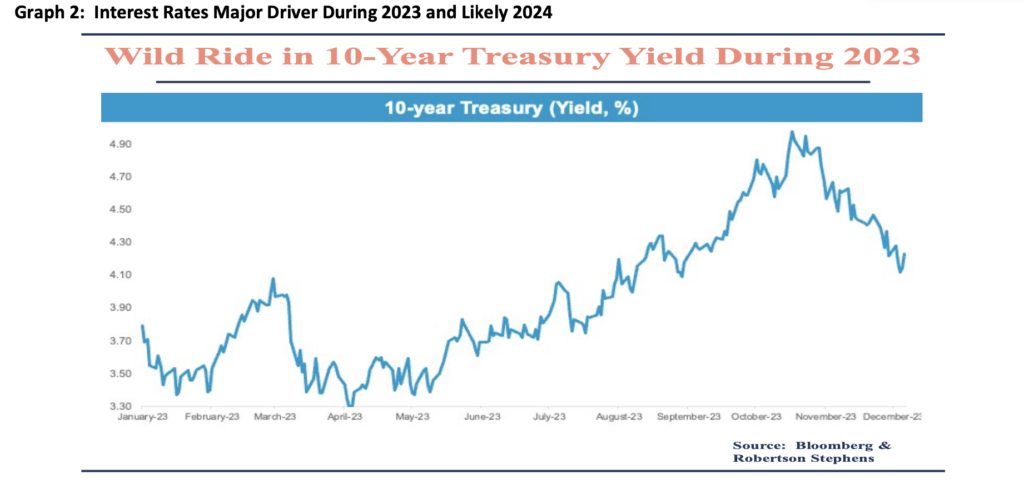

Rising interest rates in the early part of fall 2023 drove stocks down across the board. The path of the 10- Year Treasury interest rate can be seen above in Graph 2. During October and early November, as rates increased, the S&P struggled. Then with the hint of slowing inflation and the possibility that the Federal Reserve may cut the benchmark interest rate next year, the S&P 500 rallied into the end of the year as interest rates declined. Again, M&W participated in this market movement and we finished 2023 quite pleased with the performance of our portfolio and the companies that comprise the portfolio.

Out of Consensus Thoughts for 2024.

At this time of year, many market pundits publish their forecasts for the following year. Others state outlandish predictions. Still others discuss outcomes that are not in the financial media consensus, but could dramatically affect market values. We would like to humbly offer five scenarios that we think are out of consensus today, but we leave room in our minds for the possibility of one or more of these scenarios coming to fruition. These ideas are not meant to be “stunners,” but realistic scenarios.

- By the end of 2024 the Federal Reserve will not have decreased the Federal Funds Rate at all. This would likely pressure markets in the short-term, as seen above. However, we view today’s interest rate environment as more healthy for savers and for corporate decision making than the rate environment of the last decade plus.

- Connected to #1, inflation will remain in certain areas like raw materials and energy. A number of reasons could contribute to this idea. Geopolitical flare-ups comprise one possible contributor.

- By the time of the November US Presidential election results, the market expresses contentment/understanding of the outcome by not increasing or decreasing greater than 10% between the election and the end of the year. As we sit here today, it looks like the two majorparty candidates are known and the market has experience with each as Chief Executive.

- Mag 7 stocks (discussed above) end 2024 positively, but the S&P Equal Weight index ends the year within plus or minus three percentage points of the S&P 500 index. This compares with a 12 and half point lag as 2023 draws to a close. This would translate to broader stock participation, asmentioned earlier, among the S&P 500 index members during 2024.

- The US consumer does not retrench in a way to pressure the overall US economy. In other words,employment remains strong and as a result purchases of goods and services remain elevated.

The year 2023 contained a number of unexpected and market moving events. We navigated those by investing in strong companies, purchased at reasonable valuations. We are sure 2024 will bring a similar amount of surprises. Maybe some of the out of consensus thoughts above will come to fruition and likely there will be things that we do not see coming. So, if you have short-term (meaning zero to 18 months) cash flow needs that we have not discussed, please reach out. We want to prepare for those needs with you and ensure your portfolio is positioned to meet those uses of cash.

If you have any questions about the above or anything else, please contact us. We love to chat with you. Thank you for your trust and ongoing support. Have a great 2024!

Sorry, the comment form is closed at this time.