19 Dec Major Indices Push Higher in 2017 but Could See More – 2018 Q1 Commentary

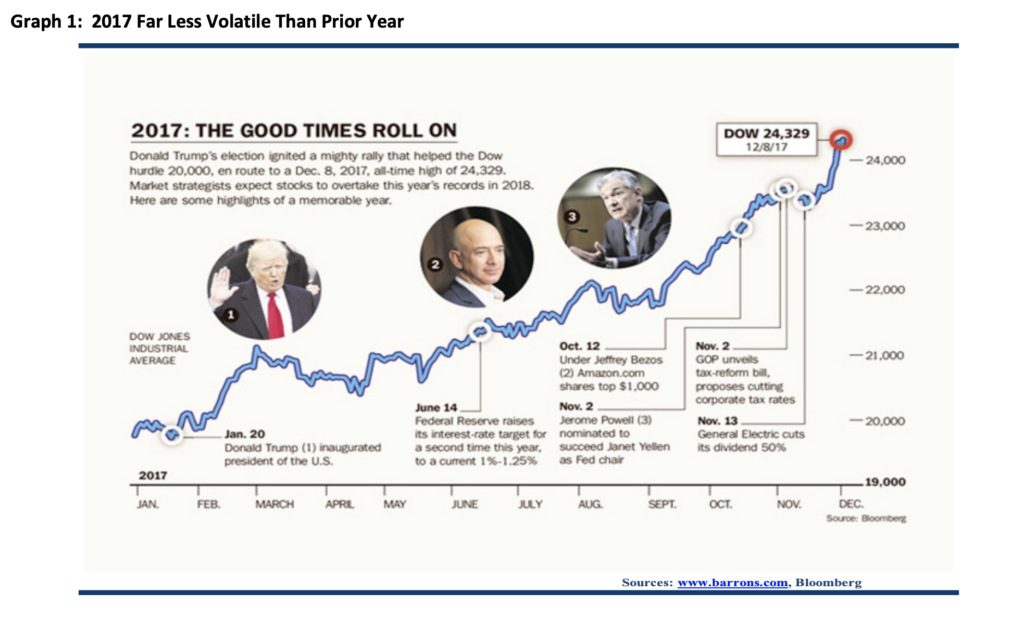

At this time last year we wrote to you regarding the volatility experienced in the US stock markets during 2016. We cannot say the same about 2017. Though we do not expect you to be able to read the small print, Graph 1 illustrates the gentle ride upward witnessed over the course of 2017. Several things contributed to this including decent corporate earnings, a lack of significant interest rate raises, the promise of tax reform, and a lack of questions around global economic growth, to name a few. As we begin a new year we consider some issues that could propel or derail stock market returns.

First, new tax legislation dramatically reduces corporate tax rates – from 35% for full payers to 20%. We thought the legislation would come a bit faster than we have seen, but ultimately we view this as significant for corporations’ earnings. If the bill adds 5-10% to S&P 500 companies’ earnings, then the 2018 Price to Earnings ratio of the S&P 500 amounts to 17-18x, which is not cheap. However, we do not view this sort of valuation as bubble territory either.

Within the aforementioned S&P 500 we would suggest that there are several large companies that provide a relatively outsized weighting to the measurement of the index’s return. A number of those companies have much higher P/E ratios than what we mentioned above. This suggests the average S&P 500 company may have a P/E ratio well below the average discussed above.

Second, at this time last year we referenced the potential under the new administration for infrastructure projects to boost the US economy. We saw little of that in 2017 of any meaningful size or scale. Once the tax bill passes, we can envision the administration working on some larger scale infrastructure programs. Not to mention, Mother Nature has sadly supplied many shovel ready projects in what was a far more volatile year for the environment than the stock market.

Third, with few major looming threats to the market – geopolitical squabbles aside – one of the keys for continued strong returns includes the acceptance of new Federal Reserve Chairman, Jerome Powell. The market expects him to follow the same slow and telegraphed pathway of interest rate raises that his predecessor Janet Yellen followed. However, any deviation from that and a move to increase rates faster than previously thought – be it to help corral inflation, not present today, or some other reason – could unsettle the stock market.

If the slow and steady path of interest rate raises continues, we would expect the market to track higher in 2018. Despite the S&P 500, Dow Jones Industrial Average, and the NASDAQ all having risen significantly in 2017, we note that the Value Line 1700 (1700 largest US stocks equal weighted) only increased 53% of the S&P 500 at the time of writing. Graph 2 depicts that even the S&P 500, led by the massive gains in large technology stocks, still finds itself well below its trailing 15 year annualized return of 11.0%. At the time of this writing, the S&P 500 returned 7.4% per year on a trailing 15 year basis. So despite high valuations within the index, as pointed out earlier, actual returns to the index have not been at prior bubble levels. Again, we take this as a good sign for future returns as long as corporate earnings continue to grow and interest rate policy remains accommodative.

At some point we will experience greater market volatility than we had the benefit of avoiding in 2017. As we continue to protect and grow your assets, we will attempt to recognize the root of that volatility and prepare the portfolio for it. In the meantime, thank you for the trust placed in us to manage your money and we look forward to another good year in 2018!

Sorry, the comment form is closed at this time.