01 Oct Financial Housekeeping & Questions – 2019 Q4 Commentary

Our end of year client housekeeping consists of several things but includes two primary pieces. This newsletter will discuss those things. It will also cover things that you might want to consider prior to transitioning into the New Year.

The first piece of yearend housekeeping for us begins in early November as we look at all of our clients’ accounts who have Required Minimum Distributions (RMDs) that must be withdrawn by year end. If the client has recently reached the age of 70-1/2, we make them aware of the withdrawal requirement and discuss how they would like to receive the funds. It is important for the client to discuss the RMD with their accountant to determine if taxes should be withheld and in what amounts. For those clients who have been receiving distributions, we check to be sure that the RMD for this year has been withdrawn or is scheduled to be completed prior to December 31st.

Secondly, we begin to review client taxable accounts for tax loss harvesting. By that we mean that we look to offset any realized gains for the year with currently unrealized losses, effectively reducing capital gains taxes. We do our best to manage a tax efficient investment strategy. We attempt to receive long- term tax treatment on all of our investments and look to offset gains when we can. We proactively act upon the above items. The rest of the newsletter will cover things you may want to consider.

In a tax regime of fewer deductions, the tax benefit of giving appreciated stock from taxable accounts is still meaningful. The end of the year is when many clients choose to make charitable donations by gifting low basis stock, receiving the largest “bang for your buck”. We would ask that you make those requests as early as you possibly can to ensure that they are completed well before the end of the year. Although the brokerage firms are very good at what they do, they also become overwhelmed at year end by sheer volume of requests. As a rule of thumb, we prefer to have all gift requests in by mid-December. If you have an RMD in a Qualified Retirement Account, remember that you have up to $100,000 in gifts that you can make from such accounts while counting them toward your RMD. Charitable donations may be taken from any account and we can provide you with the necessary forms to make those gifts.

Have you experienced any life changes or do you foresee any life changes over the next five years that will affect your financial position? As part of our fiduciary relationship, we are here to help you plan for these anticipated changes and make sure that you can address anything that comes up from a cash flow standpoint. It is better to plan for these events and be ahead of the game. We believe it is best for you to raise needed cash during times of tranquility rather than market stress. We are happy to meet with you and discuss these changes and how we can assist you.

Do you need to do some estate planning or make estate planning changes? Many of our clients have worked through estate planning details but have experienced changes to their situation over the course of the year that require document adjustments. Whether it is starting from scratch or discussing needed changes to estate plans, we can have a conversation about that and analyze what makes sense. We can also refer a number of trust and estate attorneys who can help plan and execute the necessary documents. Along with estate planning, if you have experienced changes during the year to your IRA beneficiaries, please let us know and we can complete the proper paperwork in order to complete the beneficiary changes.

Have you separated from an employer and want to move that retirement plan to a rollover IRA that we can manage? If so, prior to yearend is a great time to consider this. Similarly, do you have a number of old IRAs that we can consolidate into one in order to simplify your financial picture? We do that all the time as well and the yearend is a perfect time to work on the simplification process. We frequently see clients work on account simplification around tax time as a result of gathering various tax documents. That works too. But if you can do it prior to yearend, then you will not have to worry about tax documents for the following year in the account(s) you choose to consolidate.

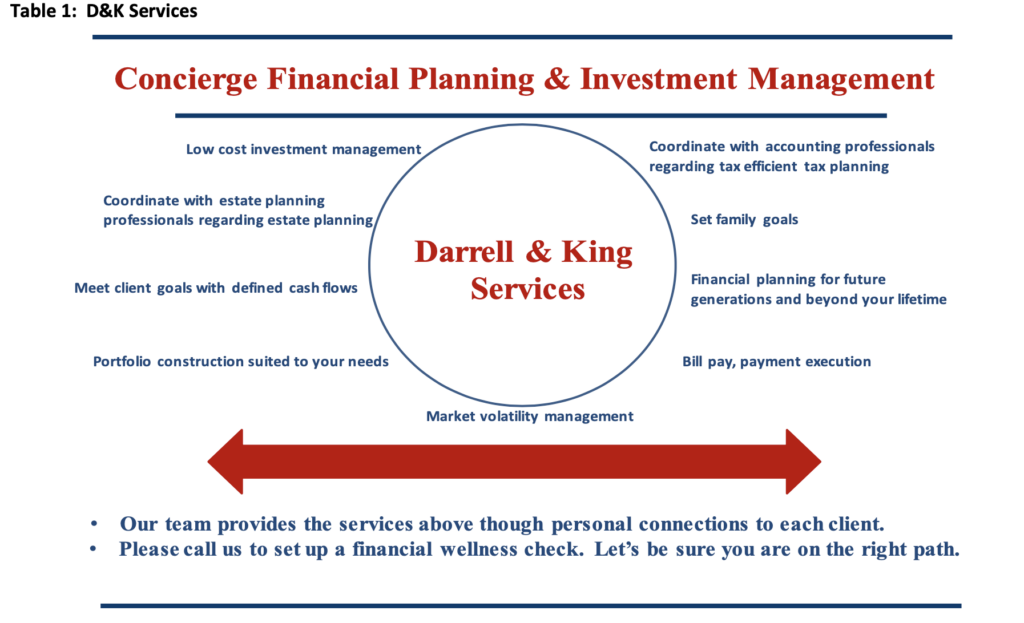

As we have seen above, the end of the year is an excellent time to consider various changes. It can also be an excellent time to either chat with us on the phone or better yet come in for a visit and have a one- on-one, yearend financial checkup. That may not sound like exactly what you want to do leading into the holidays. However, we find that generally once a client experiences our cash flow planning, discussion, and budgeting process, they leave with a lot more confidence in the future. Table 1 illustrates everything that we offer. Wherever you find yourself among the financial life stages – first income stage, dependents stage, growth stage, pre-retirement stage (period before receiving social security), and retirement stage – our cash flow planning usually adds clarity to your life. We would love to meet with you.

Finally, among yearend considerations and thinking about the life stages above and your personal risk tolerance, do you want to decrease the volatility of your portfolio? We manage bonds for clients using the same investment strategy as we do for stocks. Bonds can provide stability and relieve stress in times of market downturns. They will likely not provide as high returns as stocks over time, but sometimes clients simply want an increased peace of mind regarding their assets. We are happy to address that and frequently that decision will come out of the types of discussions covered above.

Thank you as always for the trust placed in us and we wish you the best as we move toward yearend!

Sorry, the comment form is closed at this time.