06 Jul Investing During Uncertain Times – 2020 Q3 Commentary

We once again hope this finds you physically safe and in good health. A lot has transpired since we sent our April 1st newsletter to all of our clients. The stock market movement since then has been unprecedented with more uncertainty on the horizon. At the time of writing, your stock portfolio contains a blend of high quality growth companies and industry leading cyclical companies. The volatility of the market has allowed us to follow our mantra that volatility provides opportunity. The recent volatility created opportunities from our perspective that did not exist at the beginning of 2020. We have taken advantage of those opportunities but that uncertainty we see ahead may create additional opportunity between today and the end of the year.

Part of that uncertainty stems from all of us remaining embroiled together in a pandemic. The social distancing discussed in our April 1st newsletter seems to have served its purpose of allowing healthcare systems to prepare to handle continued cases of Covid-19 caused by the novel Coronavirus, and a possible further onslaught of cases during the regular flu season beginning in the fall. We write at a time when the relaxation of social distancing has led to increases of Covid-19 cases in certain areas. This makes sense to us as well as the fact that a lot more testing for Covid-19 is being done around the country today. We continue to monitor the number of known Covid-19 infections and Covid-19 deaths reported by the Center for Disease Control (CDC) and Johns Hopkins University daily on their websites. At this point the number of deaths attributed to Covid-19 in the US amounts to almost 130,000. However, we remain optimistic regarding the deaths relative to estimated infections, especially if our infections multiplier is low.

In Graph 1, above, we observe the rolling 14 day cumulative known Covid-19 infections reported in the US by Johns Hopkins and the rolling 14 day cumulative Covid-19 related deaths reported in the US by the CDC. We chose to use 14 day cumulative totals because that is the reported likely longest duration of the disease. This time period captures the infections most representative of what is occurring in the country at the moment, rather than say two months ago, which does not matter today. The deaths number is a more certain number than infections because a cause of death is attributed for each death that occurs. Certainly, some deaths could be misclassified but that count is easier to ascertain than infections. The medical community assumes a numerical multiplier on the current reported infections. In Graph 1 we have assumed that multiplier is 5x. That means that to estimate actual current Covid-19 infections one would multiply today’s known number of infections by five. Some would estimate the multiplier as much higher than 5x, possibly 10x-20x. The dark blue line in Graph 1 measures the reported rolling 14 day cumulative deaths divided by five times the rolling 14 day cumulative known infections (dark red line) – the so called death rate. That calculations has thankfully been in decline since mid-May. We continue to monitor it. Our calculation of the death rate amounted to 0.34% at the time of writing. If we used a larger multiplier of known infections, say 10x, the death rate would drop to 0.17%. Conversely, if the multiplier of known infections is actually less than the 5x we used in Graph 1 then the death rate would increase but the number of people in the US infected with Covid-19 would be less than many thought.

From a portfolio management perspective, we manage with the above in mind but realize our healthcare system risks being overwhelmed by Covid-19 cases. Part of the uncertainty mentioned above comes from the slowdown in economic activity associated with state shelter-in-place orders and social distancing guidance. The stock market reaction in April and May seems to reflect optimism that the slowdown will not last forever. The correct magnitude of the recovery can be debated but if we do not continue to see economic recovery into the fall, then the stock market rebound could indeed falter. At this point we believe that if the economy can continue to open up, the monthly economic numbers later this year will show massive increases in comparison to the April and May figures.

Outside of the uncertainty created by Covid-19 and the related economic slowdown, uncertainty comes in the form of the November US election season, which has not yet kicked into full gear, unemployment, US racial tension and explorations, and geo-political flare-ups. We discuss, analyze, and consider these and other uncertainties internally every day. None of these issues generates the level of concern today that would lead to the conviction to position the portfolio for a direct response to a particular issue.

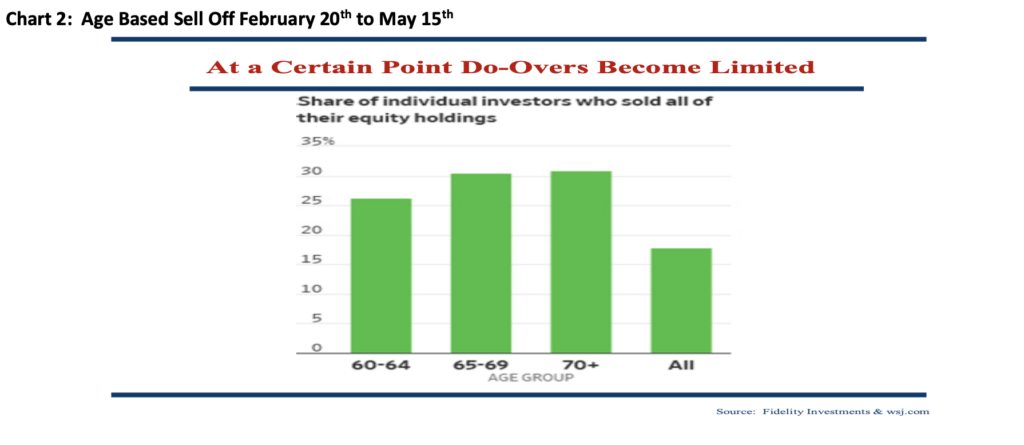

Graph 2, above, illustrates one of the crippling effects of uncertainty that we see with investors generally. Over the years we have prevented a number of clients from succumbing to this psychological challenge. We see that from February 20th to May 15th more than 30% of investors 65 and older sold off all of their stock holdings. The mistake of selling out of the market at the bottom and then waiting on the sidelines until it has recovered will not irreparably damage someone at age 25. That person has a whole career ahead of herself or himself to save and invest assets. However, for someone at age 80, living on his or her portfolio of assets, this maneuver could permanently impair years of income drawn from that portfolio.

Fortunately, during times of uncertainty, we provide the analysis and psychological support for our clients not to make this sort of permanent impairment. As you know, our range of services includes portfolio management but extends to cash flow planning and financial management, all the way to family office services. If you feel uneasy about the future or think that you and your family might benefit from a further discussion on these topics, please let us know.

Thank you for your continued trust during a particularly tumultuous time in the markets and all of our lives. We appreciate the many communications we have experienced over the last several months and look forward to continuing those conversations into the future. Stay healthy!

Sorry, the comment form is closed at this time.