15 Dec Investment Strategy In Practice – 2021 Q1 Commentary

We wish you and all of your families a Happy New Year, as well as, peace and the continued pursuit of happiness. One would not describe 2020 as peaceful. A lot of people experienced great loss as a result of Covid-19. This loss is not limited to physical and financial, but also the mental anguish of isolation and wondering whether a pathway forward would emerge. Fortunately, through the science and technological advancements of modern medicine, we do seem to see a light at the end of the Covid-19 tunnel. If you have been affected by the destruction of the virus, you can always call and talk through things with us. We have worked with a number of you on trying to fill voids, financial and otherwise, wrought by Covid-19.

Since the great financial crisis (GFC) or housing crisis of 2008 to today, things in the stock market had been relatively tranquil. There were some ups and downs, including three, uncovered by the financial media, bear markets as measured by the Value Line 1700 index. However, the market crash caused by the global onset of Covid-19 included a much larger decline and had market participants questioning what the future would hold. Fortunately, as events unfolded throughout March 2020, we followed the investment strategy that has served us so well.

The wreckage of the virus could be felt most acutely by the stock market in late March into early April. Panic and the fear of businesses never opening again likely reached their height then and into early summer 2020. We have always preached and will continue to preach that volatility breeds opportunity. Although we are sure that some clients tire of the sermon, we have conviction and will continue the investment discipline around this mantra. We have followed an investment strategy agnostic to so called “style boxes,” which means we do not look at just “value” investments or “growth” investments, or “small cap” investments, or “large cap” investments. We look opportunistically across the various categories of potential stock investments and we continue to look for ideas with 50-100% return potential over a three to five year time horizon. That has been our strategy since the move from a pure “value” strategy in the mid 1990’s, and it continues to be our strategy.

When we surveyed the investment landscape in early March 2020, we saw a declining stock market that we had expressed caution about coming into the year. As the stock market continued downward we put some of the cash we had been holding on the sidelines to work. As a result of our go anywhere strategy, we bought shares of some technology companies that had previously been too expensive for us to consider prior to the Covid-19 news flow. A number of these investments would in the near future be referred to as “work from home” (WFH) stocks. At the time we believed these companies represented strong businesses with earnings streams that would be less disrupted as a result of a global virus. By the beginning of April our purchases of those types of investments were complete – with the exception of two WFH picks unrecognized by the market that came later. As the next nine months unfolded we continued to identify investment opportunities whose share prices had not yet reflected the possibility that at some point in time business will return to normal – not to mention the large quantity of fiscal and monetary stimulus.

Some of those investment opportunities included what the industry would classify as “value” stocks. The companies varied in size. However, the common thread was management had been suggesting a stabilization in the businesses and an adaptation to the new reality of a Covid-19 operating environment.

We purchased shares in those businesses prior to the market accepting this stabilization. As market participants realized our holdings’ businesses would not remain down in perpetuity, the businesses’ stock market valuations rerated upward. In some cases this positive stock market rerating meant significant gains in the portfolio in a relatively short period of time. You directly benefited from us investing prior to the “all clear” signal from the market. In general, our analysis attempts to position the portfolio investments prior to the market recognizing the full value of the underlying business.

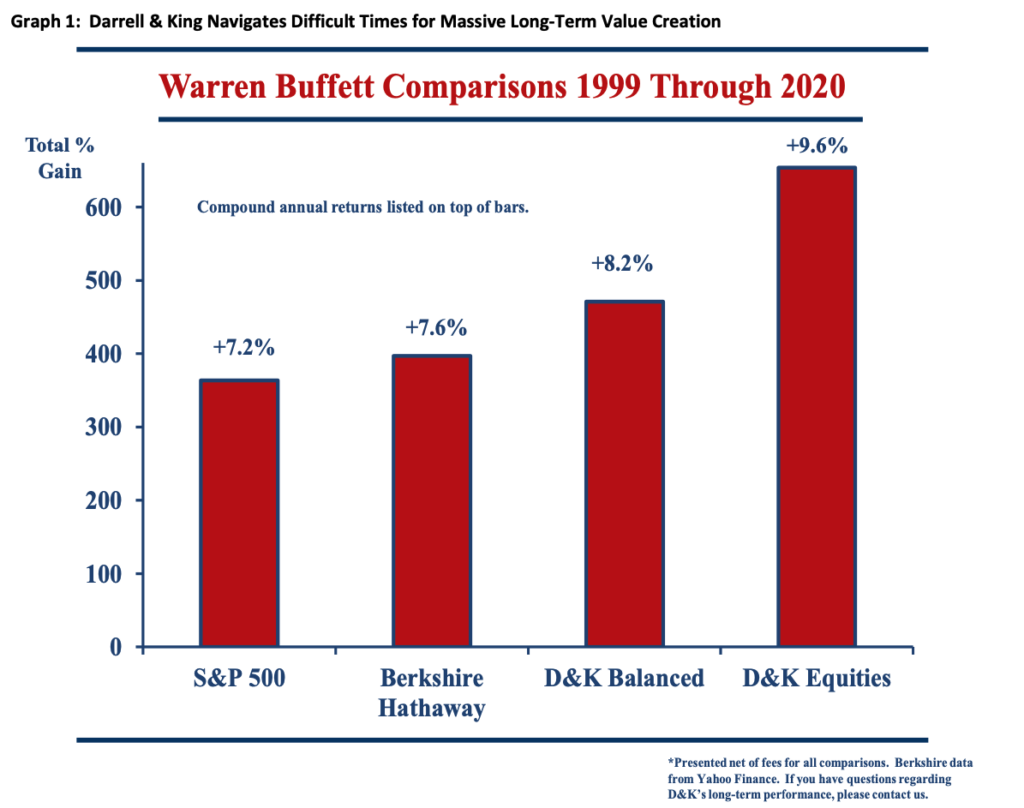

Periods of volatility like the Covid-19 crisis create the ability to take advantage of a completely new opportunity set of investments. We avoided technology stocks in the late 1990’s and early 2000’s and took advantage of underpriced cyclical stocks, which outperformed as tech stocks crashed. In 2007, we sold the stocks that were most exposed to a decline in the real estate market prior to the market collapse in 2008 – that included all of our financial sector holdings. We then took advantage of cheap consumer discretionary and economically sensitive stocks to lead the way out of the GFC during 2009. The next major market disruption came during the recent Covid-19 crisis and we executed our strategy as stated above. The execution of our investment strategy has led to the 20 year track record pictured in Graph 1 below.

We are undoubtedly proud of the results above and the value created for our clients. However, we are equally proud of staying true to our investment strategy and following our own sermon that volatility provides opportunity. As 2021 unfolds, and likely provides more volatility, we will continue to follow our investment strategy to protect and grow your assets.

As we noted in the beginning, the ongoing battles with Covid-19 are unsettling even if the virus has not affected you directly. We would love to talk with you at any time regarding changes in your life or to discuss anything you have read here. We appreciate the trust you have placed in us, especially in managing the financial market volatility of 2020. Thank you!

Sorry, the comment form is closed at this time.