02 Oct Investment Update & New SEC Form – 2020 Q4 Commentary

Our optimism remains high regarding the potential investment outcomes as we move forward from the onset and rapid outbreak of Covid-19 – including the national spike in case numbers that we observed in July and November. Since October, case numbers and death numbers have significantly surpassed the prior July peak. The US media drew a lot of attention to Americans becoming less attentive to social distancing practices over the 4th of July weekend. The resulting focus on masking and other efforts to slow the spread of Covid-19 appear visible in Graph 1 below. This is an extension of the graph we presented in last quarter’s newsletter. We believe that a similar lack of attentiveness to healthier practices has led to the recent spike. The positive news is that the death count as a percentage of the known cases using a 5x multiplier, appears to have declined – currently at 0.18%. That means that we calculate that 0.18% of people who contract Covid-19 die from Covid-19. That number would be lower if the known infection multiplier was greater than the 5x we used below and it would be lower adjusting for deaths from solely Covid-19 rather than a comorbidity. We would expect this “death rate” to increase as it did following the July increase in cases, then decline with a lag following a hopeful decline in cases. The above data is frightening in itself, but we remain optimistic about the reaction by our citizenry to the July spike and that we will correct the current upswing in cases by greater diligence around health and distancing protocols.

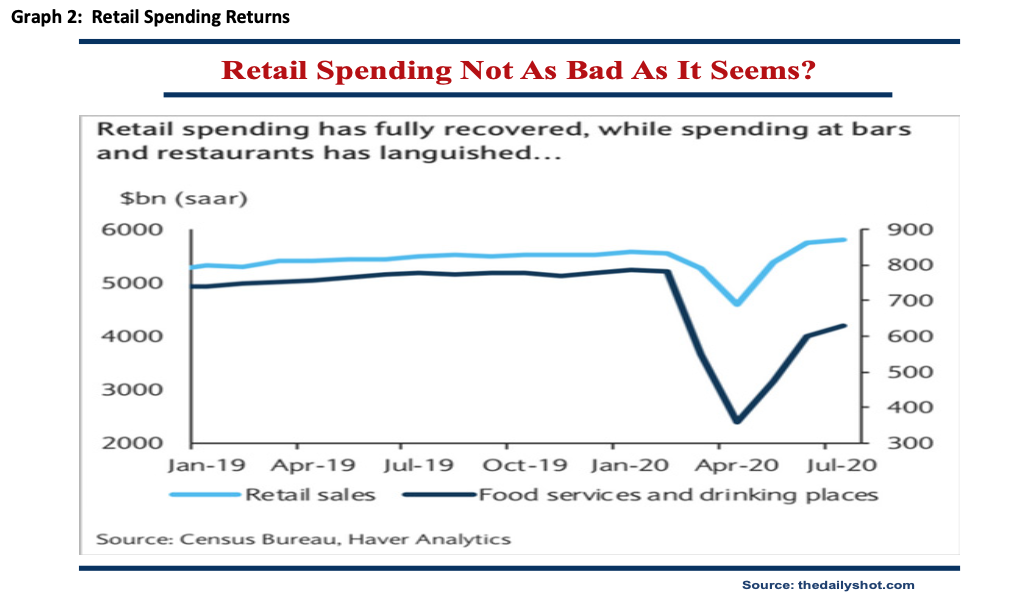

In the meantime, we are seeing a return of certain activity, which also increases our optimism in the economy growing out of the Covid-19 induced malaise. Graph 2, below, demonstrates that overall spending may not be as reduced as one might assume. Retail spending has returned to pre-Covid levels, which we view as positive in terms of returning to a more normally functioning economy. Graph 2 also shows that restaurant and bar spending in the US has not returned to pre-Covid levels. This does not surprise us but the increase off of the bottom represents another positive sign – that if Americans can safely return to prior activity, then they will. If that occurs then a number of investment opportunities offer significant appreciation. Although the market indexes and a number of individual stocks have rallied significantly since late March, a number of companies’ stocks remain depressed. As you know, we have positioned the portfolio to take advantage of several of these.

As a result of the aforementioned rally from late March a number of you have asked us whether we should “take money of the table.” We always attempt to maximize profits and limit your losses in individual securities – primarily by constantly updating price targets and our internal return estimates, but also by starting with an expected return for each security of 50-100%. The latter process results in an implied margin of safety for each stock. In part, due to this framework, we do not attempt to time the market around events such as the recent US election. However, we do have the flexibility within our investment philosophy to strategically raise cash and attempt to redeploy it for maximum profit. Therefore, if you see cash in your portfolio that is not a result of a conversation with you and our subsequent cash flow planning, then it is a result of our investment strategy at that point in time. Long-term we want to be fully invested but over shorter periods of time, like the tech crash of the late 1990s, you may see strategic extra cash in your portfolio.

The United States Securities and Exchange Commission (SEC) required that all Registered Investment Advisors (RIAs) submit a new form – the Client Relationship Summary (CRS) – by June 30, 2020. The

SEC wanted a way for individual investors to compare RIAs across five questions – asked and responded to in plain English. You can find the form enclosed with this newsletter and at www.sec.gov.

The questions include:

- 1) What investment services and advice can you provide me?

- 2) What fees will I pay?

- 3) What are your legal obligations to me when acting as my investment advisor? How else doesyour firm make money and what conflicts of interest do you have?

- 4) How do your professionals make money?

- 5) Do you or your financial professionals have legal or disciplinary history?

As you read through the CRS you can see the straight forward and clear manner with which we approach your assets and the management of our business. We hope that if you or anyone else were to scrutinize our CRS next to a competitor’s, that you would agree how clear we are in our approach to this significant piece of all of our lives.

The CRS also allows clients and potential clients to see the services that we provide inclusive of our relationship. As a reminder, our primary focus is always to protect and grow your assets. However, we work with clients on everything from financial and cash flow planning, to estate planning, to more intricate family office services and dealings.

The CRS also mentions that we offer 401(k) plans for businesses. For larger retirement plans (more than a few people) we do work with a third party, Everington LLC, to offer a high service and low cost comprehensive 401(k) plan. Under that relationship we are simply an investment option within the plan that Everington offers and we only receive compensation should a plan participant utilize us as an investment option. Additionally, if you run a business that offers a 401(k) plan or you have influence over the investment options within a plan, we have built an investment vehicle called a Collective Investment Trust (CIT). The Darrell & King CIT can be added as an investment option on almost any 401(k) plan – even if that plan is not maintained by Everington.

If you have questions regarding the form CRS or anything highlighted above, please let us know. We would be happy to work through your questions with you. Furthermore, since 1975 we have never advertised – outside of some charitable sponsorships and articles in local papers. We rely on referrals from our clients and word of mouth from us being out in the community to grow our business. We really appreciate when our clients do provide referrals and introduce us to people looking for answers to questions regarding their financial situation or investment management needs. Those introductions continue to be the lifeblood of our business. We always strive to provide you and any referrals with the highest level of service and responsiveness while maintaining a keen focus on the investment landscape. Please find a summary postcard of our offerings enclosed with this newsletter.

We hope that this finds you healthy and surviving the myriad personal challenges that Covid-19 and life generally may have presented this year. If you want to discuss any changes in your life, we are here to listen. Thank you, as always, for your trust!

Sorry, the comment form is closed at this time.