06 Jun Keeping Perspective – 2017 Q3 Commentary

This quarter’s newsletter does not directly relate to investing, although it provides an interesting framework for investing and life in general. The news flow of today seems very polarizing – we would not blame you for thinking that traditional outlets like cable news providers Fox and CNN, appear to cover breaking news for entirely different planets. However, like we tell ourselves, we advise you to keep perspective on all news flow. You have likely read or seen something in the news that personally disturbed you over the last six months. We want to demonstrate how one can maintain perspective regarding a given issue.

During the recent presidential campaign and through today, the issue of immigration became a heated topic of debate, anger, and frustration. The president won the campaign while suggesting he would build an unprecedented wall along the United States’ southern border. By watching any of the cable news channels, or reviewing any political news websites, or just perusing your Facebook news feed, one would think that immigration to the US had never been higher and if we did not address this issue

immediately, the country may stop functioning. These types of dramatic feelings signal you should most likely look further into a given issue – and keep perspective.

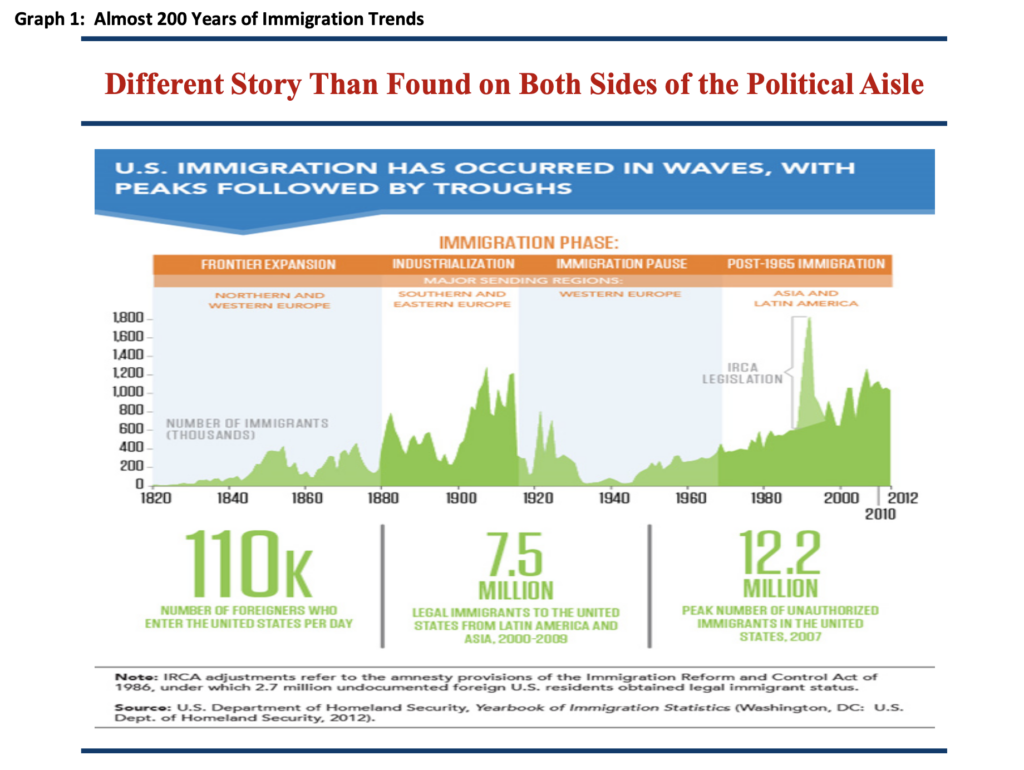

We do not want to have a politically based discussion of the immigration issue. We would rather keep perspective and determine whether we need to adjust our investment portfolio based on any change in immigration patterns to the US. If we examine Graph 1, above, from the US Department of Homeland Security, we see that the number of immigrants in 2010, did reach one of the highest levels of immigration into the US ever on an absolute basis – not including the amnesty period around 1986, which granted 2.7 million undocumented aliens legal immigration status. So in terms of concern we understand how that fact alone may seem alarming. However, let’s keep perspective of three things. First, Graph 1 appears rather cyclical. Second, 2010’s absolute level of immigration appears to have been matched around the time of World War I. Third, the 2010 population amounts to 3.3 times the population in 1910.

How does this perspective help us think about the feelings that arise when the news pushes our emotions hard to the left or the right on the immigration issue or any issue? First, since immigration does seem cyclical, we can conclude that despite arriving at a potential cyclical high, history has demonstrated that this high will likely reverse. Second, why would we have a higher degree of concern or fear about immigration today, when we know that the US survived and thrived with the high immigration levels of the World War I period? Third, the Migration Policy Institute states that US legal immigration in 1910 amounted to 1,041,570 people, compared to 1,042,625 in 2010 – almost the same number. However, according to the US Census Bureau, the US population amounted to 92,228,531 in 1910 compared to 308,745,538 in 2010. So immigrants as a percentage of the 1910 population amounted to 1.1% compared to 0.3% in 2010.

Based on the perspective in the paragraph above do we need to make immigration a focal point of our economic and investment research? We would conclude that although the issue of US immigration can conjure many feelings and there may be related security issues, we do not need to focus on this issue as meaningfully affecting the economy or our investment portfolio. We can only draw that conclusion by looking at history and data and judging where we stand today when compared to those things. We use immigration as one example of keeping perspective but we have done it throughout the firm’s existence and hope to continue to do so, while achieving strong results for the portfolio.

Thank you for keeping perspective with us and trusting us to invest your assets.

Sorry, the comment form is closed at this time.