01 Jul Maneuvering Through A Recession – 2023 Q3 Commentary

Current Market Conditions –

The year began frenetically as market pundits had a lot to discuss and gnash their teeth on. The bank crisis of March led to concern regarding further bank runs and destabilization of the US banking system. This was followed by the debt ceiling standoff, which politicians did not resolve until late May. Now that investors have moved on from those two items, recession appears the concern most top of mind.

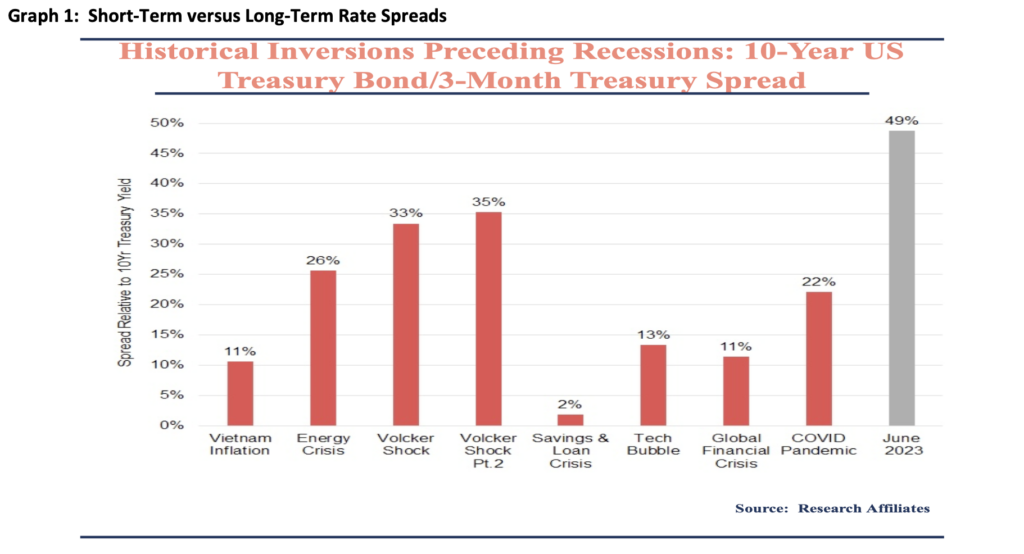

Despite government statistics not yet officially declaring a recession, we believe that the US has already entered a recession, especially within the portion of the economy selling goods. Many companies have warned of a slowdown in sales of goods, ranging from sporting equipment to construction equipment. Anecdotally, one trucking company told us that three of its large public clients’ shipping volumes declined 12%-19% in the recent reporting period. Graph 1, below shows that the 3-Year Treasury Bill Yield (or interest rate) is 49% greater than the 10-Year US Treasury Bond yield. That represents the highest relative spread preceding any of the recessions going back to the 1960’s. Generally speaking, when short-term rates are higher than long-term rates, the credit market is predicting a recession because the spread implies it is more risky to borrow in the short-term than for the years following a potential recession.

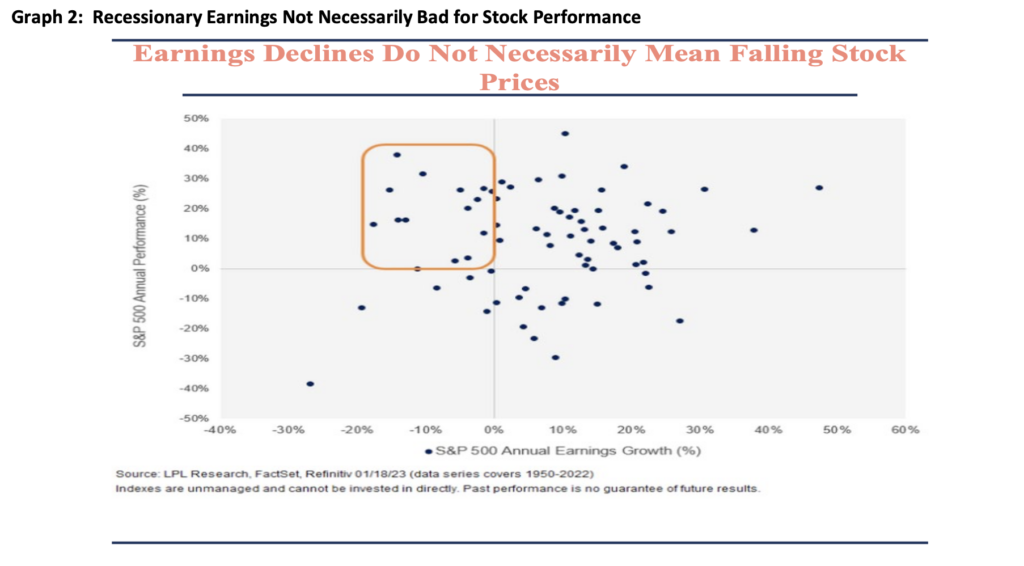

What does this mean for you and our stock portfolio? Knowing that we expect some form of recession, though we do not know if that will be shallow or deep, we must press forward and invest in the kinds of companies that can weather a recession. We invest in companies that have shown an operational adeptness that could lead to these companies coming out of a recession in better financial positions. Similarly, Graph 2, demonstrates that from 1950 to 2022, S&P 500 annual earnings declines do not necessarily lead to negative S&P 500 annual performance. We think we could experience a situation similar to this and that the market may have discounted a recession already. Overall market valuations outside of the mega capitalization technology companies do not appear stretched to us at this time.

Estate Planning –

A non-market concern that some clients share comes in the form of the expiration of the Tax Cut and Jobs Act (TJCA) – especially as it applies to the estate tax. The individual estate tax exclusion amount moved from $5.6 million in 2018 to $12.92 for the 2023 tax year. That means that a couple in 2023 with an estate less than $25.84 million would not be taxed on any of that dollar amount if they happened to both die in 2023. However, any amount above that (assuming they pass together) is taxed at the 40% estate tax rate. The concern comes that if the TJCA expires, then the individual estate tax exclusion amount could revert back to the $5.0 million limit of 2010, prior to inflation adjustments. That would imply that after 2025 a couple would have a $10 million estate exclusion, and anything above that would be taxed at 40% when the last person in the couple passed. So what can a couple in that situation do to prepare?

Currently, the IRS allows for a $17,000 annual gift exclusion each year. That means one can give up to $17,000 to anyone without the recipient or the giver filing a gift tax return. Additionally, that means a couple could give anyone an annual gift of $34,000. The implication is that a couple with two married children and four grandchildren between those couples could give away $272,000 each year. That amount would be removed from the estate tax calculation for the couple. This has a couple of implications. First, if you think you will be close to a reconfigured estate tax exclusion, you can likely reduce that tax charge by giving away your estate to loved ones (or others) while you are living. Second, the recipients of these gifts enjoy them during your life time.

In addition to the annual $17,000 gift exclusion, one can pay an accredited academic institution any fees and tuition directly to that institution and not have that amount count against one’s estate tax exemption. For example, if a grandchild has a $60,000 tuition and fees bill from a private high school, a grandparent could pay that while reducing his or her estate. The rising cost of higher education has been a burden on all, but if you fall into the category of reducing your estate for tax reasons, paying for education is a way to do that while seeing the benefits accrue to the student.

If you have any questions about the above or anything else, please contact us. We love to chat with you. Thank you for your trust and ongoing support.

Sorry, the comment form is closed at this time.