23 Jun Searching for Opportunity in an Excited Market – 2021 Q3 Commentary

Since the last time we wrote, a lot has changed in our daily lives. It is likely that as you read this you feel that you have been able to return to a little more of your “normal” routine. You may find yourself dining inside restaurants, attending church in person, taking children or grandchildren to summer camp, or planning travel. Whatever excites you about the “reopening” of all our lives, we hope you enjoy it!

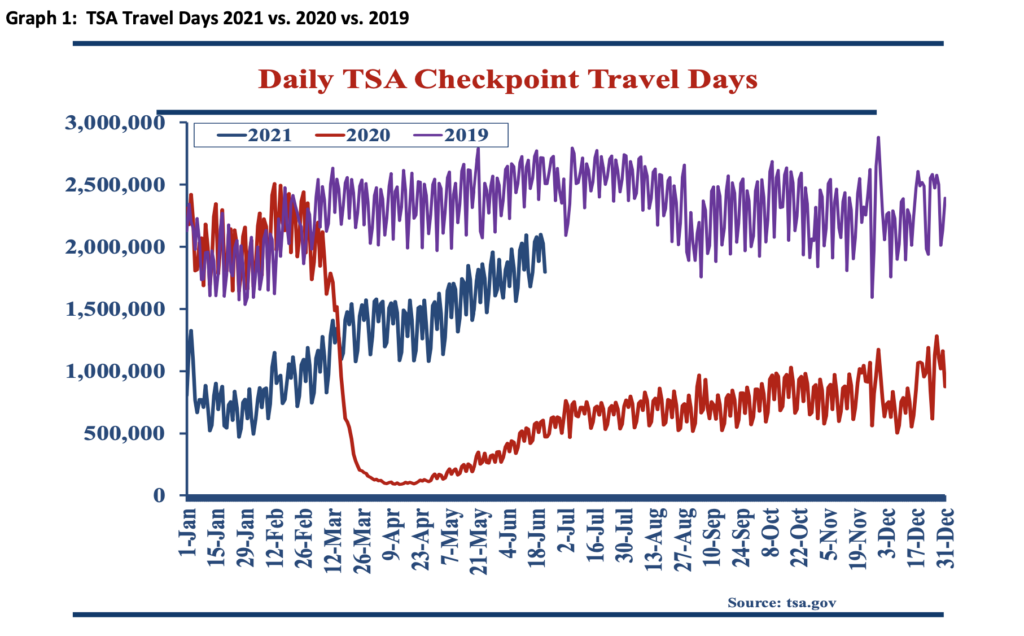

Graph 1, below, illustrates what we are talking about. American citizens, along with global citizens, have been locked down due to Covid 19. However, Graph 1 demonstrates that, as measured by TSA checkpoint travel days, Americans are getting back out and traveling. It would not surprise us to see American travel days back to 2019 levels by the end of July. That likely includes significant fewer business travel days due to many Americans still working from home offices. This excites us.

The enthusiasm can be felt on other levels in addition to a personal level. Many asset markets have shown excitement for the “reopening.” Whether as a result of widespread corporate earnings growth off of depressed Covid levels or workers getting back to jobs lost during Covid, there is an expectation that the economy and stock market will do well. When something seems expected by the market and the pundits, we attempt to look at things from a different angle.

With a lot of the above excitement visible in the stock market we attempt to invest in companies where the full opportunity for total return has not yet been realized. For example, Graph 2 illustrates how disliked the Energy industry has become – especially relative to Technology and Communication Services. This led us, in part, to reevaluate our investment in Energy. Beginning in the winter and continuing into the early part of 2021, we began our reinvestment in the Energy sector. Fortunately, our investment occurred before oil prices started to move upward.

Our attempt to find opportunity in this excited market is not limited only to broad sectors – like Energy – we can also look for idiosyncratic opportunities. One of those companies has operated in one business for many years, generating a lot of cash flow that the company spent on the buildout of another technology. If the company has success with the new technology, stock returns could be significant. Along similar lines, another recent investment we found among the excitement of the overall market could be described as a “special situation.” A merger of one company and a business unit of another company presents an opportunity for significant gains when the dust settles and all the market participants understand the benefit of the transaction. Neither of the companies above fits the description of inclusion within the aforementioned broad market excitement. We find comfort in that and believe the portfolio will benefit from that sort of thinking if the overall excitement retrenches – and even if it does not.

We wish you a wonderful summer! If you have any questions, please reach out to us. As always, thank you for your trust – we appreciate it.

Sorry, the comment form is closed at this time.