02 Apr The Batting Average – 2019 Q2 Commentary

We discussed the downward turn in the market during the fourth quarter of 2018 in our first quarter 2019 newsletter. We can summarize that newsletter, as well as past and future communications, by saying that as investors we must live with and embrace volatility. Sure enough the first quarter’s market performance showed an increase despite many of the same global concerns persisting. That return to your portfolio does not occur if your investment managers jump around or pull significant amounts of money out of the market.

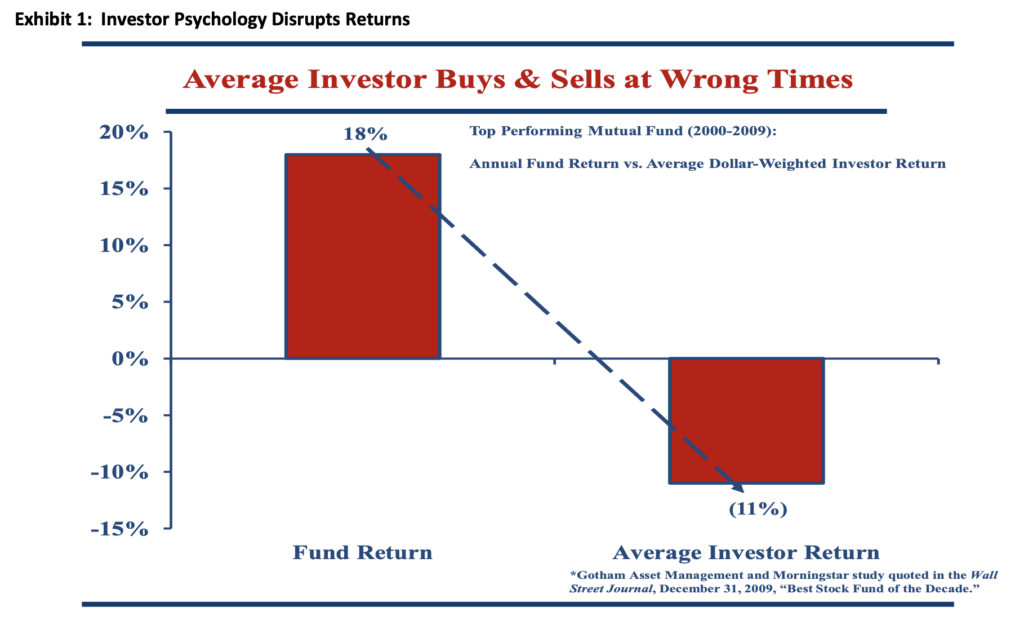

Exhibit 1 presents a study done by Gotham Asset Management and quoted in an article in the Wall Street Journal, and the finding has major implications on all of us as investors. The study found that during the period of the so called “lost decade” from 2000-2009 the best performing mutual fund returned 18% per year. An incredible figure and almost unbelievable. However, the same study demonstrated that the average investor in that high performing fund returned negative 11% per year over the same period. A figure almost as equally unbelievable! This means that the average investor in the fund pulled his/her money out and put it in at exactly the wrong times – they sold low and bought high. We see this as a powerful illustration of human psychology.

Accordingly, we can apply a finding like this to our own investment strategy. We have to avoid jumping in and out of stocks at the wrong times – selling low and buying high. Part of what our clients pay us to do is manage this element of human psychology. In times of volatility like the fourth quarter of 2018, when our stocks are low, we constantly evaluate for changes in the fundamentals of the business. If our growth expectations of those businesses remain robust and valuations remain attractive, we will keep an investment in the portfolio. If we find changes to the underlying business caused by the prevailing economy or some other factor, we may sell the investment and move on to a better opportunity. However, we will not sell an investment solely because the overall market finds itself at a lower point than the prior quarter.

The above illustration depicts what goes on with the human brain during times of market stress. We view this with understanding and compassion. We do not like to see account balances decline either. The same phenomenon can happen independently of the overall market. An individual stock within the portfolio may be in a loss position. We constantly perform the analysis described above on a company by company basis to determine whether we believe a company should remain in the portfolio. The analysis comes down to the operational performance of the underlying business and its stock market valuation. If we remain positive on both, we will likely stay with the investment regardless of its position as an unrealized gain or loss within the portfolio.

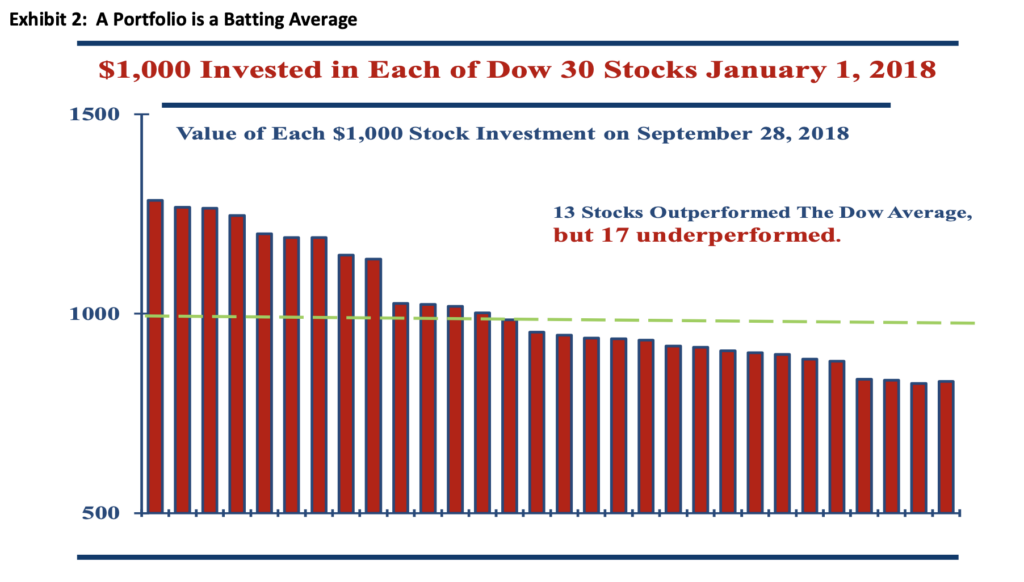

Where the psychology of portfolio management comes in can be clarified with a random point in time of the Dow Jones Industrial Index (DJIA). Exhibit 2, below, depicts the DJIA components at the end of the third quarter 2018 based on $1,000 investment in each component at the end of 2017. At that random point the DJIA had risen almost nine percent for the year, but only 13 of the 30 stocks had made money during that period. The DJIA had 17 losers out of 30 stocks. We refer to a portfolio of stocks as a batting average, and this example of the DJIA at a random point in time perfectly illustrates the concept. In this case, the DJIA was batting 0.433 (13 divided by 30) in the year-to-date period. We aim for a higher batting average on your behalf, but our portfolio can certainly look similar at any given point in time. We cannot give in to the human psychology that unrealized losses are always bad. Sometimes the market does misprice fundamentally sound companies, and it would be a mistake to sell those early.

We continue to approach the market and your portfolio rationally. Thank you for your trust and traveling this volatile journey with us!

Sorry, the comment form is closed at this time.