01 Jan Through Market Volatility the Goal Remains Constant – 2019 Q1 Commentary

Stock market indices experienced far greater volatility during 2018 than in 2017. As of December 31, 2018, the S&P 500 had declined 20% from its September high and bounced back a little, the NASDAQ had been down as much as 23%, the Russell 2000 (small companies) remained down 25% from its September high, and the Value Line 1700 had declined as much as 25% from its August high. A bear market typically gets defined as down 20%. In our view, the Value Line 1700 represents the performance of the average stock. So in 2018, as we saw from the end of 2015 through February of 2016, the average stock has suffered a bear market.

This has not felt good to any of us. We appreciate the thoughts and questions from those of you who have called or emailed us. We share your concern and note that part of our job is to manage through constant market volatility, including the occasional bear market. We understand you feel worried, and we consciously try to remain calm and make investment decisions that will benefit all of us when the bear market does turn. To that end, we like where the portfolio is positioned today with a blend of reasonably valued growth companies and distinctly undervalued industry leading companies. When downward price action occurs in the market, we strive to take advantage of it.

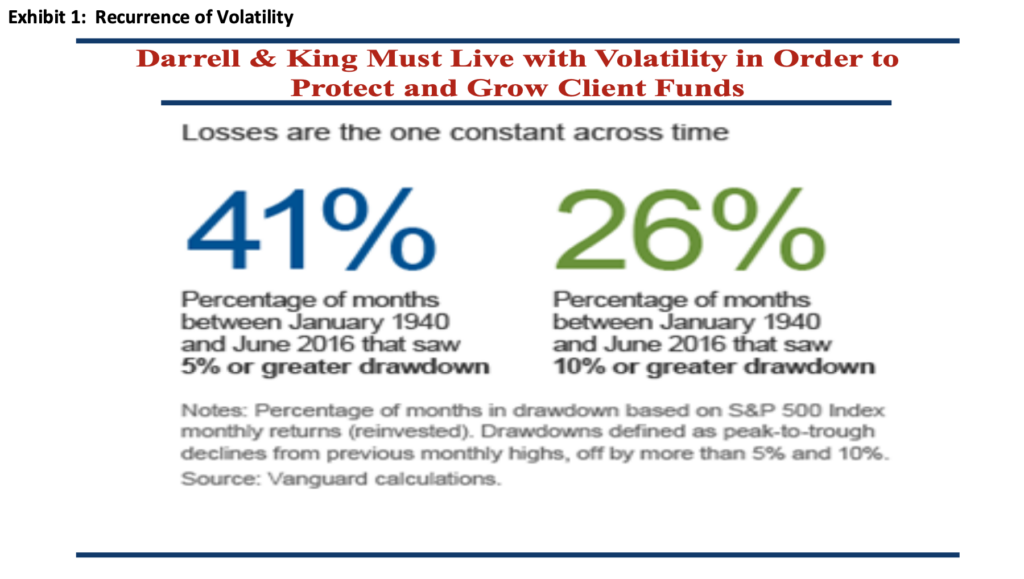

As mentioned above, that downward price action can occur frequently and relatively sharply (we would prefer not quite as harshly as in 2018). Exhibit 1 illustrates the constant volatility of the stock market. You may have seen this exhibit from us in the past, but we believe it is crucial to you and our investment philosophy. According to Vanguard, since 1940, the S&P 500 has experienced a decline of 5% or more during 41% of months. Meanwhile, during 26% of months over the same time period, the S&P 500 has experienced a decline of 10% or more – indicating a full quarter of months experience a decline of 10%!

Not only should we read the above and question the efficiency of markets, but we should all consider what that means for our mental health. Compared to the gentle low volatility 20% rise in US stock markets during 2017, Exhibit 1 illustrates a wild and bumpy ride. As we said, part of our job is to endure the bumpy ride, and make sound investment decisions based on the environment present at the moment. The intrinsic value of companies within the S&P 500 does not drop 10% or more in a quarter of all months – even if the value prescribed by the stock market might. So when the stock market moves like that, it presents opportunities. If we attempted to guess at every monthly drawdown we would indeed find ourselves checking our own mental health. Instead, unless there is something significant that we feel conviction about to keep us out of the market, we stay invested and take the opportunities as they come and attempt not to anchor to former portfolio highs, becoming frozen when the market moves lower.

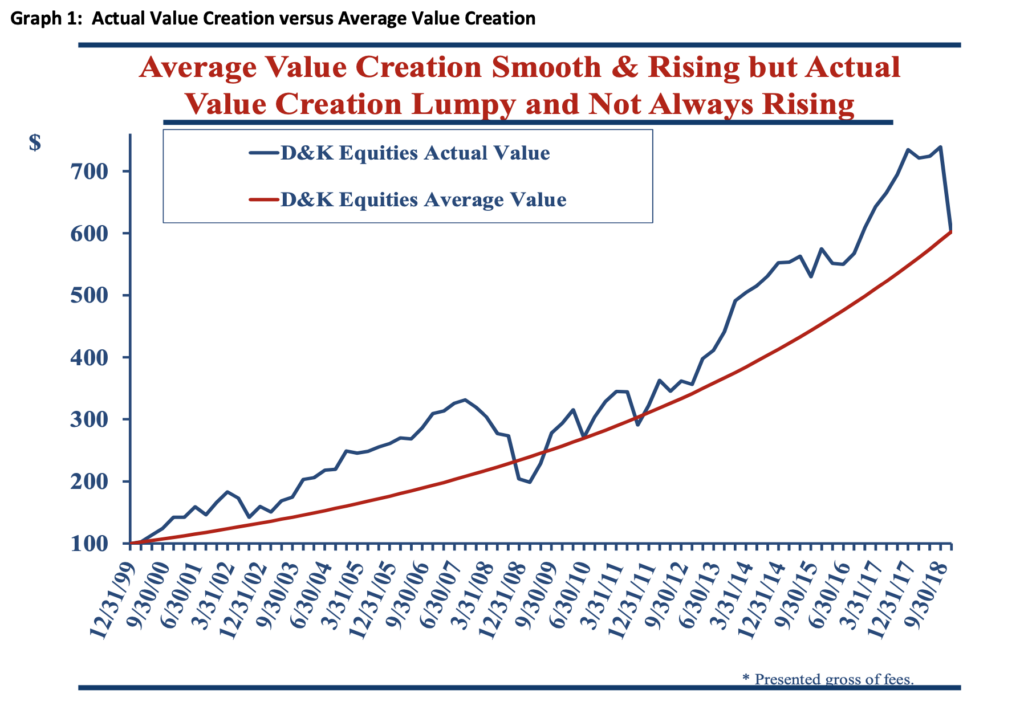

If we had anchored to a former portfolio high in late 2007 any number of negative outcomes may have occurred. Graph 1, below, illustrates the value of $100 invested in our stock portfolio since the end of 1999 (in blue) compared to the value of $100 invested at the average annual performance of our stock portfolio over the same time period (in red). By late 2007 our portfolio had more than tripled. If we lamented losing that former peak and sold out of stocks at the market bottom of early 2009, we may not have reached a new high value in the portfolio for several additional years. Instead, we invested during early 2009 in the beaten down consumer discretionary sector, which led to a large bounce back in the portfolio. The portfolio value then went on to achieve greater highs. Interestingly, despite the difficult close to 2018, the value of $100 invested with us at the end of 1999 has still increased six times. The value created amounts to the same but unfortunately the market does not offer us the red line of Graph 1 to achieve it. It is precisely at this point that we do not want to act rashly, anchor on earlier high points in value creation, lament the declines, and forgo future value creation.

We believe that the stock market declines in value will be temporary if our companies continue to report strong earnings and grow their capital bases via cash flow generation. If those things continue, then we think a number of our companies remain significantly undervalued and that panicking now would be akin to panicking at the end of 2008 or beginning of 2009. The economy and our companies have the earnings power to continue to grow. There are a number of question marks around politics, foreign relations, and the economy, but as demonstrated by the shear frequency of volatile down movements in the S&P 500, those types of questions remain with us most of the time.

One of our goals with the management of your portfolio is to determine which questions are significant and which ones are passing. At this time we do not have the conviction regarding a specific question to withdraw from the market. So we look past the prior high in value created within the portfolio and attempt to construct a portfolio to surpass it. That being said, we understand that these sorts of market drawdowns can be nerve wracking. If you would like to speak further about the market, our views, the portfolio, cash flow planning, or anything else on your mind, we welcome your calls and emails.

Thank you for the trust placed in us and we look forward protecting and growing your assets in 2019!

Sorry, the comment form is closed at this time.